To effectively manage your finances, it is crucial to have a clear understanding of your income and expenses. Income refers to the money you earn from various sources, such as your salary, bonuses, rental income, or investments. It is essential to account for all forms of income, as this will provide a comprehensive view of your financial situation.

This holistic approach allows you to gauge your financial health accurately and make informed decisions. On the other hand, expenses encompass all the costs associated with your daily life.

These can be categorized into fixed expenses, such as rent or mortgage payments, utilities, and insurance premiums, and variable expenses, which include groceries, entertainment, and discretionary spending. Understanding the distinction between these two types of expenses is essential for effective budgeting. For example, while fixed expenses are generally predictable and stable, variable expenses can vary significantly from month to month.

By analyzing both income and expenses, you can identify areas where you may be overspending or where you can cut back, ultimately leading to better financial management.

Key Takeaways

- Understanding your income and expenses is crucial for effective budgeting

- Setting realistic financial goals helps you stay focused and motivated

- Utilize budget tracking tools to easily monitor your spending and saving

- Create and maintain a budget tracker to keep your finances organized

- Track and analyze your spending habits to identify areas for improvement

- Adjust your budget as needed to accommodate changes in income or expenses

- Stay disciplined and consistent with your budgeting efforts for long-term success

- Seek professional financial advice if needed to ensure you are on the right track

Setting Realistic Financial Goals

Creating SMART Goals

Once you have a firm grasp of your income and expenses, the next step is to set realistic financial goals. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For instance, instead of stating a vague goal like “I want to save money,” a more effective goal would be “I want to save $5,000 for a vacation within the next 12 months.” This specificity not only provides clarity but also helps in tracking progress over time.

Creating a Balanced Financial Plan

Setting short-term goals, such as saving for a new gadget or paying off a credit card, alongside long-term goals like retirement savings or purchasing a home can create a balanced financial plan. Moreover, it is essential to prioritize these goals based on urgency and importance. For example, if you have high-interest debt, paying it off should take precedence over saving for a luxury item.

Allocating Resources and Adjusting Goals

By categorizing your goals into immediate needs and future aspirations, you can allocate your resources more effectively. Additionally, regularly revisiting and adjusting these goals as your financial situation changes is crucial. Life events such as job changes, family growth, or unexpected expenses can impact your ability to meet these goals, necessitating flexibility in your planning.

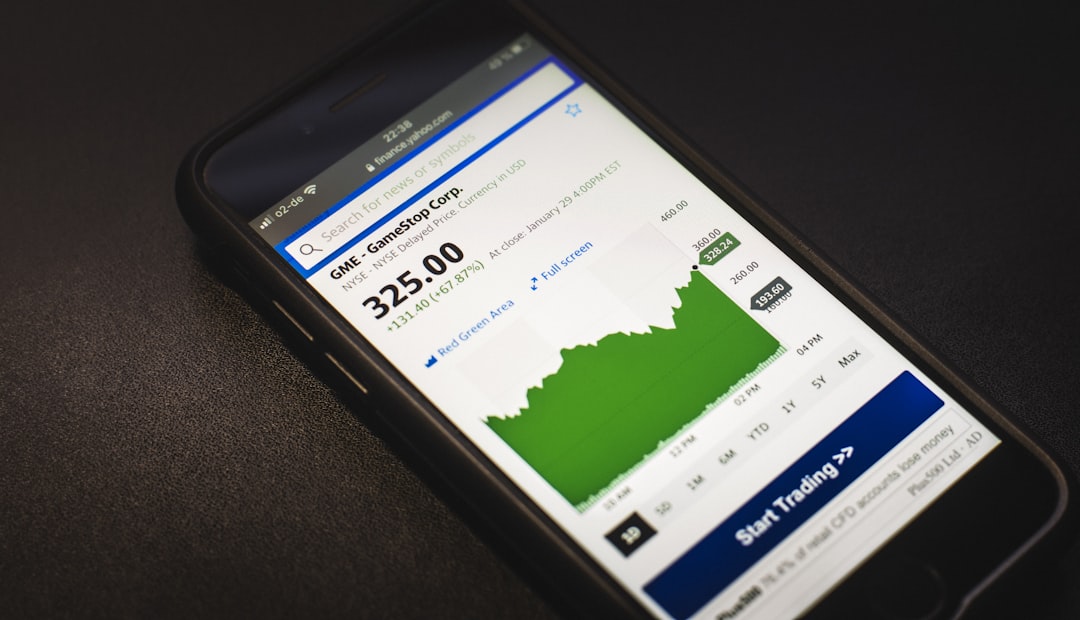

Utilizing Budget Tracking Tools

In today’s digital age, numerous budget tracking tools are available that can simplify the process of managing your finances. These tools range from mobile applications to online platforms that allow users to input their income and expenses easily. Popular apps like Mint or YNAB (You Need A Budget) offer features that automatically categorize transactions and provide insights into spending habits.

By utilizing these tools, individuals can gain a clearer picture of their financial landscape without the tedious task of manual tracking. Additionally, many budget tracking tools come equipped with features that allow for goal setting and progress monitoring. For instance, some applications enable users to set savings goals and track their progress in real-time.

This functionality can serve as a motivational factor, encouraging users to stick to their budgets and make necessary adjustments when they veer off course. Furthermore, these tools often provide visual representations of spending patterns through graphs and charts, making it easier to identify trends and areas for improvement.

Creating and Maintaining a Budget Tracker

| Category | Metric |

|---|---|

| Income | Total monthly income |

| Expenses | Total monthly expenses |

| Savings | Monthly savings amount |

| Debts | Total outstanding debts |

| Budget Variance | Difference between income and expenses |

Creating a budget tracker is an essential step in managing your finances effectively. A budget tracker can take various forms, from a simple spreadsheet to a more sophisticated software program. The key is to ensure that it captures all relevant financial data accurately.

Start by listing all sources of income at the top of the tracker, followed by fixed and variable expenses. This layout allows for easy comparison between income and expenditures. For example, if your monthly income is $4,000 and your total expenses amount to $3,500, you can see that you have a surplus of $500 that could be allocated toward savings or debt repayment.

Maintaining this budget tracker requires discipline and consistency. Regularly updating the tracker with new transactions is crucial for accuracy. Setting aside time each week or month to review your finances can help keep you accountable.

During these reviews, assess whether you are staying within your budget limits or if adjustments are necessary. For instance, if you notice that your grocery spending consistently exceeds your budgeted amount, it may be time to reevaluate your shopping habits or meal planning strategies. By actively engaging with your budget tracker, you can make informed decisions that align with your financial goals.

Tracking and Analyzing Your Spending Habits

Tracking and analyzing spending habits is an integral part of effective financial management. By keeping a close eye on where your money goes each month, you can identify patterns that may not be immediately apparent. For example, you might discover that a significant portion of your income is being spent on dining out or subscription services that you rarely use.

This awareness can prompt you to make conscious choices about where to cut back without sacrificing enjoyment in other areas of your life. Moreover, analyzing spending habits can help in recognizing emotional triggers that lead to impulsive purchases. Many individuals find themselves spending money as a response to stress or boredom.

By identifying these triggers through careful tracking, you can develop strategies to mitigate them—such as finding alternative activities that do not involve spending money or setting strict limits on discretionary purchases. This level of self-awareness not only aids in sticking to a budget but also fosters healthier financial behaviors over time.

Adjusting Your Budget as Needed

Adapting to Changes in Income

When life takes an unexpected turn, your budget should too. If you receive a sudden increase in income, consider allocating some of the extra money towards savings or debt repayment. This will help you maintain financial health and avoid inflating your spending habits.

Managing Unexpected Expenses

On the other hand, if unexpected expenses arise, such as medical bills or car repairs, revisit your budget to determine where cuts can be made without jeopardizing essential needs. This will help you navigate financial setbacks with ease.

Seasonal Budget Adjustments

Seasonal changes can also impact your budget. For instance, heating costs may rise significantly during winter months compared to summer months. By being proactive about these fluctuations, you can ensure smoother financial management throughout the year.

Regularly reviewing and adjusting your budget ensures that it remains aligned with both your current financial situation and long-term goals.

Staying Disciplined and Consistent

Discipline and consistency are fundamental components of successful budgeting. It is easy to become complacent or discouraged when faced with challenges or setbacks; however, maintaining focus on your financial goals is crucial for long-term success. One effective strategy for fostering discipline is to establish routines around budgeting practices—such as setting aside specific times each week or month for reviewing finances and updating your budget tracker.

This regularity creates accountability and reinforces the importance of staying on track. Moreover, finding ways to stay motivated can significantly enhance discipline in budgeting efforts. Celebrating small victories—such as reaching a savings milestone or successfully cutting back on discretionary spending—can provide positive reinforcement that encourages continued adherence to budgeting practices.

Additionally, surrounding yourself with supportive individuals who share similar financial goals can create an environment conducive to accountability and motivation.

Seeking Professional Financial Advice if Needed

While self-management of finances is achievable for many individuals, there are instances where seeking professional financial advice may be beneficial. Financial advisors possess expertise in various areas such as investment strategies, retirement planning, tax optimization, and debt management. If you find yourself overwhelmed by complex financial decisions or struggling to create an effective budget despite your best efforts, consulting with a professional can provide clarity and direction.

Furthermore, professional advice can be particularly valuable during significant life transitions—such as marriage, divorce, or career changes—when financial circumstances may shift dramatically. A financial advisor can help navigate these changes by offering tailored strategies that align with your unique situation and goals. Ultimately, investing in professional guidance can lead to more informed decision-making and greater confidence in managing your finances effectively over time.

If you are looking for a budget tracker app to help you manage your finances, you may also be interested in exploring Valapoint’s article on money management apps. This article provides a comprehensive overview of various money management apps available in the market, including their features and benefits. By utilizing a money management app in conjunction with a budget tracker, you can effectively monitor your expenses and stay on top of your financial goals. Check out the article valapoint.

com/money-management-apps/’>here for more information.