Understanding your spending triggers is a crucial first step in managing your finances effectively. Spending triggers are the emotional, psychological, or situational factors that lead you to make purchases, often impulsively. These triggers can vary widely from person to person.

For some, stress or anxiety may prompt them to seek comfort in retail therapy, while others might find themselves spending more during social gatherings or when they receive a bonus at work. Identifying these triggers requires a deep dive into your personal habits and emotional responses. Keeping a spending journal can be an effective method for tracking your purchases alongside your feelings at the time of each transaction.

Over time, patterns may emerge that reveal specific situations or emotions that lead to unnecessary spending. Moreover, understanding your spending triggers can also involve recognizing external influences such as advertising, peer pressure, or seasonal sales. For instance, the holiday season often brings about a surge in consumerism, with marketing campaigns designed to evoke feelings of nostalgia and generosity.

By being aware of these external factors, you can develop strategies to mitigate their impact on your spending behavior. For example, if you notice that you tend to overspend during holiday sales, you might choose to set a strict limit on your holiday budget or avoid shopping altogether during peak sale times. This awareness not only empowers you to make more informed financial decisions but also helps you cultivate a healthier relationship with money.

Key Takeaways

- Identify emotional and situational triggers that lead to overspending.

- Develop a budget that reflects your actual income and necessary expenses.

- Practice mindfulness to become more aware of spending habits before making purchases.

- Explore alternative activities or strategies to avoid impulsive buying.

- Engage with support systems or accountability partners to stay on track financially.

Creating a Realistic Budget

Creating a realistic budget is an essential component of effective financial management. A budget serves as a roadmap for your financial journey, helping you allocate your income toward necessary expenses, savings, and discretionary spending. To create a budget that reflects your actual financial situation, start by gathering all relevant financial information, including income sources, fixed expenses (like rent or mortgage payments), variable expenses (such as groceries and utilities), and any debts you may have.

This comprehensive overview will provide a clearer picture of your financial landscape. Once you have a complete understanding of your income and expenses, it’s important to categorize them appropriately. Fixed expenses are typically non-negotiable and should be prioritized in your budget.

Variable expenses, on the other hand, can often be adjusted based on your spending habits. After categorizing your expenses, allocate a portion of your income to savings and investments. A common recommendation is the 50/30/20 rule: 50% of your income should go toward needs, 30% toward wants, and 20% toward savings and debt repayment.

However, this rule can be adjusted based on individual circumstances. The key is to ensure that your budget is both realistic and flexible enough to accommodate unexpected expenses or changes in income.

Practicing Mindful Spending

Practicing mindful spending involves being intentional about your purchases and making conscious decisions about how you allocate your money. This approach encourages you to reflect on the necessity and value of each purchase rather than acting on impulse. One effective strategy for cultivating mindful spending is the “24-hour rule,” which suggests waiting 24 hours before making any non-essential purchase.

This pause allows you to evaluate whether the item is truly needed or if it was simply an impulsive desire triggered by emotions or external influences. In addition to the 24-hour rule, consider implementing a “spending fast” where you refrain from making any non-essential purchases for a set period, such as a week or a month. This practice can help reset your relationship with money and provide insight into what you genuinely value.

During this time, take note of any cravings for specific items and reflect on whether those desires stem from genuine need or external pressures. By engaging in these practices, you can develop a more thoughtful approach to spending that aligns with your financial goals and personal values.

Finding Alternative Ways to Curb Impulse Purchases

Finding alternative ways to curb impulse purchases is essential for maintaining financial stability and achieving long-term goals. One effective method is to identify activities that provide similar emotional satisfaction without the need for spending money. For instance, if shopping serves as a form of stress relief for you, consider exploring other outlets such as exercise, meditation, or engaging in hobbies that bring joy and fulfillment.

These alternatives can help redirect your focus away from shopping while still addressing the underlying emotional needs that drive impulse purchases. Another strategy involves creating a “wish list” for items you desire but do not need immediately. Instead of purchasing items on impulse, write them down and revisit the list after a designated period—say 30 days.

This cooling-off period allows you to assess whether the desire for the item persists or fades over time. Often, individuals find that many items they initially felt compelled to buy are no longer appealing after some reflection. Additionally, consider setting specific financial goals that motivate you to save rather than spend impulsively.

Whether it’s saving for a vacation, a new car, or building an emergency fund, having clear objectives can provide the necessary motivation to resist the temptation of impulse purchases.

Seeking Support and Accountability

|

|

| Strategy |

Description |

Effectiveness (%) |

Time to See Results |

| Create a Budget |

Track income and expenses to set spending limits. |

85 |

1 Month |

| Use Cash Instead of Cards |

Limits spending to physical cash on hand. |

70 |

Immediate |

| Set Spending Goals |

Define clear financial goals to motivate saving. |

75 |

2-3 Months |

| Track Daily Expenses |

Monitor every purchase to increase awareness. |

80 |

1 Month |

| Limit Impulse Purchases |

Wait 24 hours before buying non-essential items. |

65 |

Immediate |

| Use Budgeting Apps |

Leverage technology to automate tracking and alerts. |

78 |

1 Month |

| Review Subscriptions |

Cancel unused or unnecessary recurring payments. |

60 |

Immediate |

Seeking support and accountability can significantly enhance your efforts to manage spending and achieve financial goals. Sharing your financial journey with trusted friends or family members can create a sense of community and encouragement. Discussing your goals openly allows others to provide support and hold you accountable for your spending habits.

For example, if you’re working towards paying off debt or saving for a specific goal, having someone check in on your progress can motivate you to stay committed to your plan. In addition to informal support systems, consider joining financial literacy groups or workshops where individuals share similar goals and challenges. These communities often provide valuable resources and insights into effective budgeting strategies and mindful spending practices.

Online forums and social media groups dedicated to personal finance can also serve as platforms for sharing experiences and gaining inspiration from others who have successfully navigated similar challenges. By surrounding yourself with like-minded individuals who prioritize financial wellness, you create an environment conducive to positive change and accountability in your spending habits. In conclusion, understanding spending triggers, creating realistic budgets, practicing mindful spending, finding alternatives to curb impulse purchases, and seeking support are all integral components of effective financial management.

Each element plays a vital role in fostering a healthier relationship with money and empowering individuals to make informed decisions that align with their long-term financial goals. By implementing these strategies thoughtfully and consistently, individuals can navigate their financial journeys with greater confidence and purpose.

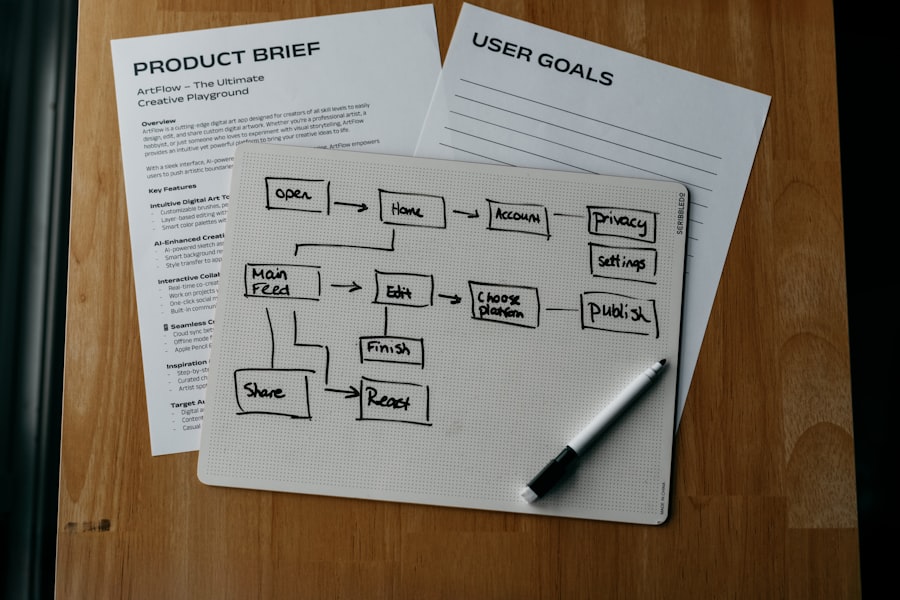

If you’re looking for effective strategies to curb overspending, you might find it helpful to explore the article on the best savings apps. These tools can assist you in tracking your expenses and setting savings goals, ultimately helping you manage your finances better. You can read more about it in this article: For example, if you choose to use a budgeting app like Mint or YNAB (You Need A Budget), these tools can link directly to your bank accounts and credit cards, providing real-time updates on your spending.

This level of visibility allows you to see how much you have left in each category of your budget at any given time.

Alternatively, if you prefer a more hands-on approach, maintaining a spreadsheet can also be effective. By entering each transaction manually, you not only keep track of your spending but also engage more deeply with your financial situation. Regardless of the method chosen, the act of tracking spending fosters accountability and encourages mindful financial decisions.

Setting Financial Goals

Setting financial goals is an essential step in achieving long-term financial stability and success. Goals provide direction and motivation, helping you focus on what truly matters in your financial life. These goals can be short-term, such as saving for a vacation or paying off a credit card debt within six months; medium-term goals might include saving for a down payment on a house or funding a child’s education; while long-term goals could involve retirement planning or building wealth through investments.

When establishing financial goals, it is important to ensure they are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, instead of stating a vague goal like “I want to save money,” a SMART goal would be “I want to save $5,000 for a vacation by December 2024.” This specificity not only clarifies what you are working toward but also allows you to measure progress along the way. Additionally, breaking larger goals into smaller milestones can make them feel more attainable and less overwhelming.

For example, if your goal is to save $20,000 for a home down payment in five years, setting a target of saving $333 per month can help you stay on track.

Saving and Investing Strategies

|

|

| Category |

Planned Amount |

Actual Amount |

Difference |

Percentage of Total Budget |

| Housing |

1200 |

1150 |

50 |

30% |

| Utilities |

300 |

320 |

-20 |

7.5% |

| Food |

500 |

480 |

20 |

12.5% |

| Transportation |

200 |

220 |

-20 |

5% |

| Entertainment |

150 |

100 |

50 |

3.75% |

| Savings |

400 |

400 |

0 |

10% |

| Miscellaneous |

250 |

300 |

-50 |

6.25% |

| Total |

3000 |

2970 |

30 |

100% |

Once you have established financial goals, the next step is to develop effective saving and investing strategies that align with those objectives. Saving is often the first step in building wealth; it involves setting aside money for future needs or emergencies. A common recommendation is to aim for an emergency fund that covers three to six months’ worth of living expenses.

This fund acts as a safety net during unexpected situations such as job loss or medical emergencies. Investing takes saving a step further by allowing your money to grow over time through various investment vehicles such as stocks, bonds, mutual funds, or real estate. The key to successful investing lies in understanding your risk tolerance and time horizon.

For instance, younger investors with a longer time horizon may choose to invest more heavily in stocks due to their potential for higher returns over time despite their volatility. Conversely, those nearing retirement may prefer more conservative investments that prioritize capital preservation over aggressive growth. Diversification is another critical strategy in investing; it involves spreading investments across different asset classes to mitigate risk.

For example, rather than putting all your money into one stock or sector, consider allocating funds across various industries and investment types. This approach helps protect against market fluctuations and reduces the impact of poor-performing investments on your overall portfolio.

Dealing with Debt

Debt management is an integral part of personal finance that requires careful consideration and strategic planning. Many individuals find themselves burdened by various forms of debt—credit card balances, student loans, mortgages—each with its own implications for financial health. The first step in dealing with debt is to assess the total amount owed and categorize it by interest rates and repayment terms.

High-interest debt should be prioritized since it accumulates faster than lower-interest obligations. One effective strategy for managing debt is the snowball method, where you focus on paying off the smallest debts first while making minimum payments on larger debts. This approach can provide psychological benefits as each paid-off debt serves as a motivational milestone.

Alternatively, the avalanche method prioritizes debts with the highest interest rates first, potentially saving more money in interest payments over time. Whichever method you choose, consistency in making payments is crucial; setting up automatic payments can help ensure that you never miss a due date. In addition to these strategies, consider exploring options for consolidating debt through personal loans or balance transfer credit cards that offer lower interest rates.

This can simplify payments and reduce overall interest costs. However, it’s essential to read the fine print and understand any fees associated with these options before proceeding.

Reviewing and Adjusting Your Budget

A budget is not a static document; it requires regular review and adjustment to remain effective in changing circumstances. Life events such as job changes, family growth, or unexpected expenses can significantly impact your financial situation and necessitate modifications to your budget. Regularly reviewing your budget—ideally on a monthly basis—allows you to assess whether you are meeting your financial goals and staying within your spending limits.

During these reviews, compare actual spending against budgeted amounts in each category. If you find that certain categories consistently exceed their budgets—such as groceries or entertainment—it may be time to adjust those figures or identify areas where you can cut back. Conversely, if you consistently underspend in certain categories, consider reallocating those funds toward savings or debt repayment goals.

Additionally, life changes may prompt new financial priorities that require budget adjustments. For instance, if you welcome a new child into your family or decide to pursue further education, these events will likely necessitate changes in how you allocate funds each month. Being flexible and willing to adapt your budget ensures that it remains relevant and effective in helping you achieve your financial objectives.

Seeking Professional Financial Advice

While many individuals successfully manage their finances independently, there are times when seeking professional financial advice can provide significant benefits. Financial advisors offer expertise in areas such as investment strategies, tax planning, retirement savings, and estate planning—knowledge that can be invaluable in navigating complex financial landscapes. When considering hiring a financial advisor, it’s essential to evaluate their qualifications and experience carefully.

Look for advisors who hold relevant certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Additionally, consider their fee structure—some advisors charge hourly rates while others work on commission or charge flat fees based on assets under management. A good financial advisor will take the time to understand your unique financial situation and goals before providing tailored advice.

They can help create comprehensive financial plans that encompass budgeting strategies, investment portfolios aligned with risk tolerance, and long-term wealth-building strategies. Moreover, they can provide accountability and guidance during market fluctuations or economic downturns when emotions may cloud judgment. In conclusion, understanding personal finance involves multiple interconnected components—from comprehending income and expenses to setting goals and managing debt effectively.

By taking proactive steps in budgeting and seeking professional advice when necessary, individuals can navigate their financial journeys with confidence and clarity.

If you’re looking for effective tools to manage your finances, you might find our article on the By reallocating these funds towards savings or investments, individuals can make significant strides toward their financial aspirations.

Ultimately, budgeting is not merely about restricting spending; it is about empowering individuals to make choices that align with their values and goals.

Key Takeaways

- Budgeting is essential for financial stability and achieving goals.

- Knowing your income and expenses helps create an effective budget.

- Setting clear financial goals guides your spending and saving decisions.

- Regularly tracking expenses ensures you stay within your budget.

- Building an emergency fund and paying off debt are key steps before investing.

Understanding Your Income and Expenses

To create an effective budget, it is imperative to have a comprehensive understanding of both income and expenses. Income encompasses all sources of money that an individual receives, including salaries, bonuses, rental income, and any side hustles. It is essential to calculate total monthly income accurately, as this figure serves as the foundation for the entire budgeting process.

For example, if someone earns a salary of $4,000 per month but also receives an additional $500 from freelance work, their total monthly income would be $4,500. This total provides a clearer picture of the financial resources available for allocation. On the other hand, understanding expenses involves categorizing and analyzing all outgoing funds.

Expenses can be divided into fixed and variable categories. Fixed expenses are those that remain constant each month, such as rent or mortgage payments, insurance premiums, and loan repayments. Variable expenses fluctuate and can include groceries, entertainment, and discretionary spending.

By meticulously tracking these expenses over time, individuals can identify patterns and make informed decisions about where to cut back or adjust their spending habits. For instance, if someone notices that they consistently overspend on dining out, they might choose to limit restaurant visits or explore more budget-friendly meal options at home.

Setting Financial Goals

Setting financial goals is a critical step in the budgeting process that provides direction and motivation. These goals can be short-term, medium-term, or long-term, depending on the time frame for achieving them. Short-term goals might include saving for a vacation or paying off a small credit card balance within a few months.

Medium-term goals could involve saving for a down payment on a house or funding a significant purchase within the next few years. Long-term goals often encompass retirement savings or establishing a college fund for children. When setting financial goals, it is essential to ensure they are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

For example, instead of stating a vague goal like “I want to save money,” one could articulate a SMART goal such as “I will save $5,000 for a vacation by setting aside $200 each month for the next 25 months.

” This level of specificity not only clarifies the objective but also makes it easier to track progress over time.

Additionally, aligning financial goals with personal values can enhance motivation; for instance, someone who values travel may find greater satisfaction in saving for experiences rather than material possessions.

Creating a Realistic Budget

Creating a realistic budget requires careful consideration of both income and expenses while factoring in individual lifestyle choices and financial goals. A budget should reflect actual spending habits rather than idealized versions of how one wishes to spend money. This means being honest about current expenses and acknowledging areas where adjustments may be necessary.

For instance, if someone typically spends $300 on groceries each month but has set a budget of $200 without considering their actual habits, they are likely to struggle with adherence to that budget. To create an effective budget, individuals can utilize various methods such as the envelope system, zero-based budgeting, or digital budgeting tools. The envelope system involves allocating cash for different spending categories into physical envelopes; once the cash in an envelope is gone, no more spending occurs in that category for the month.

Zero-based budgeting requires individuals to assign every dollar of income to specific expenses or savings until there is nothing left unallocated. Digital tools like budgeting apps can simplify this process by automatically tracking expenses and providing insights into spending patterns. Regardless of the method chosen, the key is to ensure that the budget is flexible enough to accommodate unexpected expenses while remaining aligned with financial goals.

Tracking and Managing Your Expenses

|

|

| Category |

Planned Amount |

Actual Amount |

Difference |

Percentage of Total Budget |

| Housing |

1200 |

1150 |

50 |

30% |

| Utilities |

300 |

320 |

-20 |

7.5% |

| Food |

500 |

480 |

20 |

12.5% |

| Transportation |

200 |

210 |

-10 |

5% |

| Entertainment |

150 |

100 |

50 |

3.75% |

| Savings |

400 |

400 |

0 |

10% |

| Miscellaneous |

250 |

300 |

-50 |

6.25% |

| Total |

3000 |

2960 |

40 |

100% |

Once a budget is established, the next crucial step is tracking and managing expenses diligently. This ongoing process allows individuals to stay accountable to their financial plans and make necessary adjustments as circumstances change. Tracking expenses can be done through various means—manual logging in a notebook, using spreadsheets, or employing budgeting apps that sync with bank accounts for real-time updates.

The choice of method often depends on personal preference and comfort with technology. Regularly reviewing expenses against the budget helps identify discrepancies and areas where overspending may occur. For example, if someone notices that they consistently exceed their entertainment budget due to impulse purchases or unplanned outings, they can take proactive measures to curb this behavior in the future.

Additionally, tracking expenses can reveal opportunities for savings; perhaps an individual discovers they are paying for multiple streaming services but only regularly use one or two. By canceling unused subscriptions, they can redirect those funds toward more meaningful financial goals.

Building an Emergency Fund

An emergency fund is an essential component of sound financial planning that provides a safety net during unforeseen circumstances such as job loss, medical emergencies, or unexpected repairs. Financial experts often recommend saving three to six months’ worth of living expenses in an easily accessible account designated solely for emergencies. This fund acts as a buffer against debt accumulation during challenging times and offers peace of mind knowing that there are resources available when needed.

Building an emergency fund requires discipline and commitment but can be achieved through consistent savings habits. Individuals can start by setting aside a small percentage of their income each month specifically for this purpose. For instance, if someone earns $3,000 per month and aims to save 10% for their emergency fund, they would contribute $300 monthly until they reach their target amount.

Automating these contributions can simplify the process; by setting up automatic transfers from checking to savings accounts right after payday, individuals can prioritize saving without having to think about it actively.

Paying Off Debt

Debt management is another critical aspect of personal finance that often requires attention alongside budgeting and saving efforts. High-interest debt—such as credit card balances—can quickly become overwhelming if not addressed promptly. Developing a strategy for paying off debt is essential for achieving long-term financial stability and freeing up resources for other priorities like saving or investing.

One effective method for tackling debt is the snowball approach, where individuals focus on paying off the smallest debts first while making minimum payments on larger debts. This strategy provides quick wins that can boost motivation as debts are eliminated one by one. Alternatively, the avalanche method prioritizes debts with the highest interest rates first, which can save money on interest payments over time but may take longer to see progress initially.

Regardless of the chosen method, consistency in making payments is vital; setting up automatic payments can help ensure that debts are paid on time while avoiding late fees.

Investing for the Future

Investing is a crucial step in building wealth and securing financial independence over time. While budgeting and saving lay the groundwork for financial stability, investing allows individuals to grow their money through various vehicles such as stocks, bonds, mutual funds, or real estate. The earlier one begins investing, the more time their money has to compound and grow; this principle underscores the importance of starting as soon as possible.

Understanding risk tolerance is essential when embarking on an investment journey. Different investment options carry varying levels of risk; stocks may offer higher potential returns but come with greater volatility compared to bonds or savings accounts. Individuals should assess their comfort level with risk based on factors such as age, financial goals, and investment timeline before making decisions.

Additionally, diversifying investments across different asset classes can mitigate risk while maximizing potential returns over time. For example, a balanced portfolio might include a mix of stocks for growth potential and bonds for stability. In conclusion, effective budgeting encompasses understanding income and expenses, setting clear financial goals, creating realistic budgets, tracking spending habits diligently, building emergency funds, managing debt responsibly, and investing wisely for future growth.

Each component plays an integral role in achieving overall financial well-being and security.

If you’re looking to enhance your budgeting skills, you might find it helpful to explore our article on the best budgeting and expense trackers. This resource provides insights into various tools that can complement your budget planner and help you manage your finances more effectively. Check it out here: Best Budgeting and Expense Tracker.

FAQs

What is a budget planner?

A budget planner is a tool or document used to organize and track income, expenses, and savings. It helps individuals or households manage their finances by setting spending limits and financial goals.

Why should I use a budget planner?

Using a budget planner helps you control your spending, avoid debt, save money, and achieve financial goals such as buying a home, paying off loans, or building an emergency fund.

What information do I need to create a budget planner?

To create a budget planner, you need details about your monthly income, fixed expenses (like rent or mortgage), variable expenses (like groceries and entertainment), debts, and savings goals.

How often should I update my budget planner?

It is recommended to update your budget planner regularly, ideally weekly or monthly, to reflect changes in income, expenses, and financial goals.

Can a budget planner help with debt management?

Yes, a budget planner can help you allocate funds toward paying off debts systematically, prioritize high-interest debts, and avoid accumulating new debt.

Are there digital budget planners available?

Yes, there are many digital budget planners available as apps or software, which can automate calculations, provide reminders, and offer visual reports to help manage your finances.

Is a budget planner suitable for businesses as well as individuals?

Yes, budget planners can be used by both individuals and businesses to plan income and expenses, forecast financial performance, and make informed financial decisions.

What are the common categories included in a budget planner?

Common categories include income, housing, utilities, food, transportation, healthcare, entertainment, savings, debt repayment, and miscellaneous expenses.

Can a budget planner help me save money?

Yes, by tracking your spending and setting limits, a budget planner helps identify unnecessary expenses and encourages disciplined saving habits.

Is it necessary to stick strictly to a budget planner?

While flexibility is important, consistently following a budget planner helps maintain financial discipline and achieve long-term financial goals. Adjustments can be made as circumstances change.