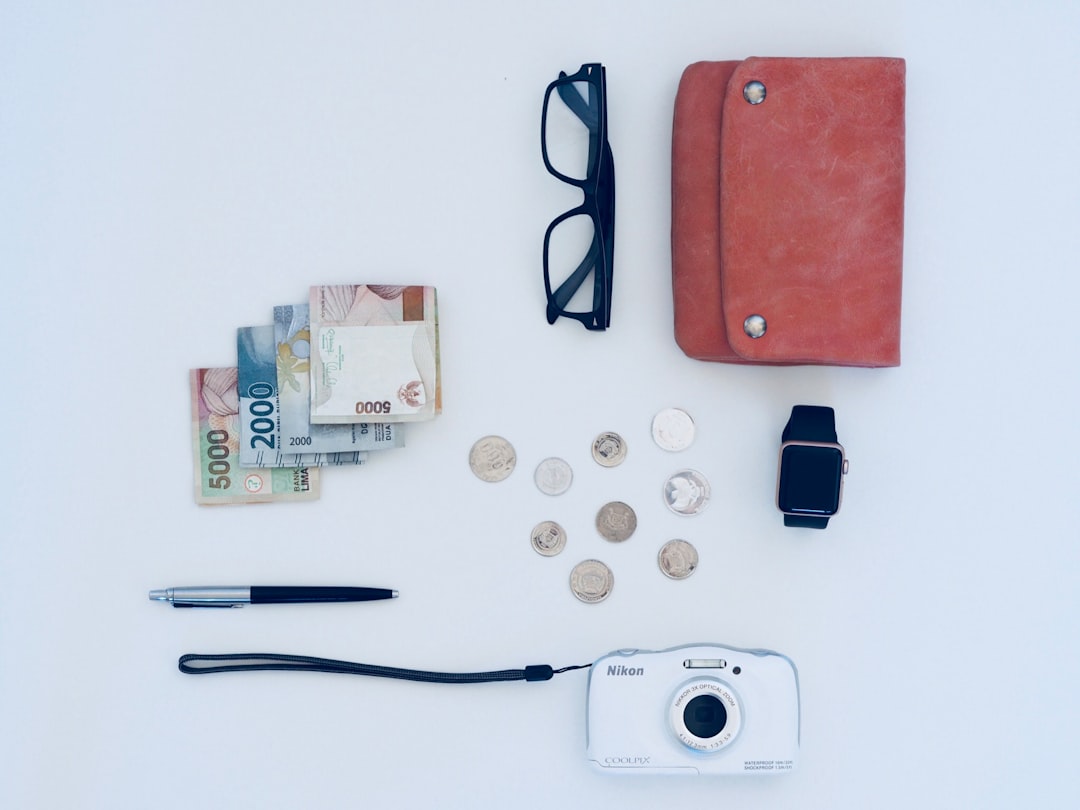

Saving money is a fundamental aspect of personal finance that plays a crucial role in achieving financial stability and security. It allows individuals to prepare for unforeseen circumstances, such as medical emergencies or job loss, and provides a safety net that can alleviate stress during challenging times. Moreover, saving is essential for reaching long-term financial goals, such as purchasing a home, funding education, or planning for retirement. By prioritizing savings, individuals can cultivate a sense of control over their financial future and reduce reliance on credit or loans.

The act of saving also fosters a mindset of discipline and foresight. It encourages individuals to think critically about their spending habits and prioritize their needs over wants. This shift in perspective can lead to more informed financial decisions and a greater appreciation for the value of money. In an era where consumerism often overshadows the importance of saving, understanding its significance can empower individuals to take charge of their financial well-being and work towards a more secure future.

Building a savings habit is essential for achieving financial stability and reaching long-term goals. One effective way to start saving is by tracking your expenses, which can help you identify areas where you can cut back and allocate more funds towards savings. For more insights on managing your finances effectively, check out this related article on expense management at Valapoint. By implementing the strategies discussed, you can develop a more disciplined approach to your spending and savings.

Key Takeaways

- Saving money is crucial for financial security and future goals.

- Set achievable savings goals to stay focused and motivated.

- Track expenses and create a budget to manage finances effectively.

- Automate savings to ensure consistent contributions without effort.

- Build an emergency fund and explore various savings options for flexibility.

Setting Realistic Savings Goals

Establishing realistic savings goals is a vital step in the journey toward financial health. Goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For instance, instead of setting a vague goal like “I want to save money,” one might specify, “I want to save $5,000 for a vacation within the next year.” This clarity not only provides direction but also makes it easier to track progress and stay motivated.

When setting savings goals, it is important to consider both short-term and long-term objectives. Short-term goals might include saving for a new appliance or a holiday gift, while long-term goals could involve building a retirement fund or saving for a child’s education. Balancing these goals can help maintain motivation and provide a sense of accomplishment as milestones are reached. Additionally, revisiting and adjusting these goals periodically can ensure they remain relevant to changing circumstances and priorities.

Creating a Budget and Tracking Expenses

A well-structured budget serves as the foundation for effective saving. It provides a clear overview of income and expenses, allowing individuals to identify areas where they can cut back and allocate more funds toward savings. Creating a budget involves listing all sources of income alongside fixed and variable expenses. This process not only highlights spending patterns but also reveals potential opportunities for savings.

Tracking expenses is equally important in maintaining a budget. By monitoring daily spending habits, individuals can gain insights into their financial behavior and make informed adjustments. Various tools and apps are available to assist with this process, making it easier to categorize expenses and visualize spending trends. Regularly reviewing this information can help reinforce positive financial habits and ensure that savings goals remain on track.

Automating Savings Contributions

One effective strategy for enhancing savings is automating contributions. By setting up automatic transfers from checking accounts to savings accounts, individuals can ensure that they consistently save without having to think about it. This method not only simplifies the saving process but also helps to build savings gradually over time. Many banks offer options for automatic transfers on specific dates, aligning with paydays or other regular income sources.

Automating savings can also reduce the temptation to spend money that might otherwise be available in checking accounts. When funds are automatically allocated to savings before they can be spent, individuals are less likely to dip into those savings for non-essential purchases. This approach fosters a more disciplined financial routine and can lead to significant growth in savings over time.

Building a savings habit can be challenging, but there are effective strategies that can help you stay on track. One useful resource is an article that provides insightful budget tracking tips, which can significantly enhance your financial discipline. By implementing these tips, you can create a more structured approach to managing your finances and ultimately boost your savings. To explore these valuable suggestions, check out the article on budget tracking tips you need to know here.

Finding Ways to Cut Expenses

| Metric | Description | Example Value | Recommended Goal |

|---|---|---|---|

| Monthly Savings Amount | Amount of money saved each month | 200 | At least 20% of monthly income |

| Savings Frequency | Number of times savings are made per month | 4 | Weekly or more frequent |

| Savings Rate | Percentage of income saved | 15% | 20% or higher |

| Emergency Fund Size | Amount saved for unexpected expenses | 3000 | 3 to 6 months of living expenses |

| Automatic Transfers | Whether savings are automated | Yes | Yes, to build consistent habit |

| Time to Build Habit | Average time to establish a savings habit | 66 days | Consistent daily or weekly saving for 2+ months |

Identifying areas to cut expenses is essential for freeing up additional funds for savings. This process often begins with a thorough review of monthly expenditures. Common areas where individuals can reduce spending include dining out, subscription services, and impulse purchases. By making conscious choices about where to allocate money, individuals can redirect those funds toward their savings goals.

Additionally, exploring alternatives can lead to substantial savings. For example, cooking at home instead of dining out not only saves money but can also promote healthier eating habits. Similarly, evaluating subscription services and canceling those that are underutilized can free up funds without sacrificing quality of life. Small changes in daily spending habits can accumulate over time, resulting in significant contributions to savings.

Building a savings habit can be a transformative step towards financial stability, and one effective way to start is by utilizing budget tracker apps. These tools can help you monitor your spending and set savings goals, making it easier to develop a consistent saving routine. For more insights on how to choose the right app to support your budgeting efforts, you can check out this informative article on budget tracker apps. By integrating such technology into your financial planning, you can cultivate a healthier relationship with your money and achieve your savings objectives more efficiently.

Building an Emergency Fund

An emergency fund is a critical component of financial planning that provides a buffer against unexpected expenses. This fund should ideally cover three to six months’ worth of living expenses, allowing individuals to navigate financial challenges without resorting to debt. Building an emergency fund requires discipline and commitment but is essential for achieving long-term financial security.

To establish an emergency fund, individuals should first determine their monthly expenses and set a target amount for the fund. Regular contributions, even if small, can help build this fund over time. It is advisable to keep the emergency fund in a separate savings account that is easily accessible but not too convenient to dip into for non-emergencies. This separation helps reinforce the purpose of the fund and encourages responsible financial behavior.

Exploring Different Savings Options

There are various savings options available that cater to different financial goals and preferences. Traditional savings accounts offer liquidity and safety but typically yield lower interest rates compared to other options. High-yield savings accounts or online banks may provide better interest rates while still maintaining easy access to funds.

For those looking to grow their savings over the long term, certificates of deposit (CDs) or money market accounts may be suitable alternatives. These options often offer higher interest rates in exchange for locking funds away for a specified period. Additionally, investment accounts can be explored for those willing to take on more risk in pursuit of higher returns. Understanding the pros and cons of each option is essential for making informed decisions that align with individual financial goals.

Staying Motivated and Consistent

Maintaining motivation and consistency in saving can be challenging, especially when faced with competing financial priorities or unexpected expenses. One effective way to stay motivated is by celebrating milestones along the way. Whether it’s reaching a certain percentage of a savings goal or successfully cutting back on discretionary spending, acknowledging these achievements can reinforce positive behavior.

Another strategy is to visualize the end goal of saving efforts. Creating vision boards or setting reminders that highlight what one is saving for can serve as constant motivation. Additionally, surrounding oneself with supportive individuals who share similar financial goals can foster accountability and encouragement. By cultivating a positive mindset around saving and remaining committed to the process, individuals can build lasting habits that contribute to their overall financial well-being.

In conclusion, understanding the importance of saving is fundamental to achieving financial stability and security. By setting realistic goals, creating budgets, automating contributions, cutting expenses, building emergency funds, exploring various savings options, and staying motivated, individuals can develop effective saving strategies that lead to long-term success. The journey toward financial health requires discipline and commitment but ultimately results in greater peace of mind and control over one’s financial future.