In an increasingly digital world, managing personal finances has become more accessible and efficient, thanks in large part to budgeting apps.

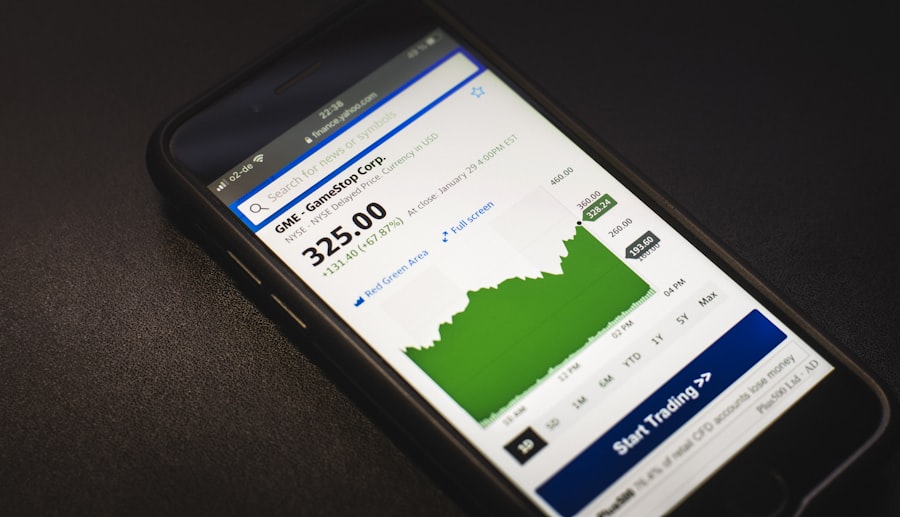

With the rise of smartphones and tablets, budgeting apps have transformed the way people approach their financial health.

They offer a user-friendly interface that allows users to visualize their financial situation in real-time, making it easier to make informed decisions about spending and saving. The importance of budgeting cannot be overstated. It serves as a roadmap for financial stability, helping users allocate their resources wisely.

Budgeting apps take this concept further by providing features that automate calculations, categorize expenses, and generate reports. This technology not only simplifies the budgeting process but also encourages users to engage with their finances more actively. As a result, budgeting apps have gained popularity among various demographics, from college students managing limited funds to families planning for long-term financial goals.

Key Takeaways

- Budgeting apps help individuals track and manage their finances more effectively

- Free budget apps offer features such as expense tracking, budget categorization, and goal setting

- Setting up a budget involves inputting income, fixed expenses, and setting spending limits for variable expenses

- Tracking expenses and income allows users to see where their money is going and make adjustments as needed

- Analyzing spending habits helps users identify areas for improvement and make informed financial decisions

Features of a Free Budget App

Essential Functionalities

One of the most significant advantages of free budgeting apps is that they often include essential functionalities without requiring a subscription fee. These features typically encompass expense tracking, income logging, and budget creation tools.

Tracking and Categorizing Expenses

Users can categorize their spending into various categories such as groceries, entertainment, and utilities, allowing for a clearer picture of where their money is going.

Syncing and Alert Features

Another critical feature of many free budgeting apps is the ability to sync with bank accounts and credit cards. This functionality enables automatic transaction imports, reducing the need for manual entry and minimizing errors. Users can set up alerts for overspending in specific categories or receive notifications when bills are due, ensuring they stay on top of their financial obligations.

Setting Up Your Budget

Establishing a budget is a foundational step in achieving financial wellness, and budgeting apps simplify this process significantly. To set up a budget within an app, users typically begin by inputting their income sources.

Once income is recorded, users can categorize their expenses into fixed costs—such as rent or mortgage payments—and variable costs—like dining out or entertainment. This categorization allows for a more nuanced understanding of spending habits. After categorizing income and expenses, users can allocate specific amounts to each category based on their financial goals and priorities.

Many budgeting apps provide templates or suggested budgets based on average spending patterns, which can serve as a helpful starting point for users who may be unsure about how to allocate their funds. As users input their data, the app will often display a summary of their budget, highlighting areas where they may need to adjust their spending to stay within their means.

Tracking Expenses and Income

| Category | Expenses | Income |

|---|---|---|

| Housing | 1000 | 0 |

| Transportation | 300 | 0 |

| Food | 500 | 0 |

| Utilities | 200 | 0 |

| Entertainment | 100 | 0 |

Effective tracking of expenses and income is crucial for maintaining a balanced budget, and budgeting apps excel in this area. Users can log transactions in real-time or import them automatically from linked bank accounts. This feature not only saves time but also ensures that users have an accurate and up-to-date view of their financial situation.

Many apps allow users to take photos of receipts or enter transactions manually, providing flexibility in how they track their spending. Moreover, the categorization of expenses plays a vital role in tracking financial health. Users can assign each transaction to specific categories, which helps them understand where they are overspending or where they might have room to cut back.

For instance, if a user notices that they are consistently exceeding their budget for dining out, they can make informed decisions about reducing restaurant visits or finding more affordable dining options. The ability to track income alongside expenses also provides a comprehensive view of cash flow, allowing users to see how much money is available for discretionary spending or savings.

Analyzing Your Spending Habits

Once users have tracked their expenses over time, analyzing spending habits becomes an invaluable exercise in financial management. Budgeting apps often include analytical tools that generate reports and visualizations of spending patterns. These insights can reveal trends that may not be immediately apparent through manual tracking alone.

For example, users might discover that they spend significantly more on coffee than they realized or that certain months lead to higher utility bills due to seasonal changes. By examining these patterns, users can make informed decisions about where to cut back or reallocate funds. Some budgeting apps even provide personalized recommendations based on spending habits, suggesting areas where users could save money or optimize their budgets further.

This level of analysis empowers users to take control of their finances by identifying unnecessary expenditures and prioritizing essential needs over wants.

Setting Financial Goals

Defining Clear Objectives

Whether it’s saving for a vacation, paying off debt, or building an emergency fund, having clear goals provides motivation and direction for users as they navigate their financial journey. Budgeting apps often include goal-setting features that enable users to specify target amounts and timelines for achieving these objectives.

Tracking Progress

Once goals are established, users can track their progress within the app. Many budgeting tools allow users to allocate a portion of their income toward specific goals automatically.

Automating Savings

For instance, if someone aims to save $5,000 for a down payment on a house within two years, they can set up a monthly savings plan that deducts a predetermined amount from their budget each month. This automated approach not only simplifies the savings process but also instills discipline in adhering to financial goals.

Saving and Investing with a Budget App

In addition to tracking expenses and setting goals, many budgeting apps now incorporate features that facilitate saving and investing directly within the platform. Users can create separate savings accounts for different purposes—such as travel funds or emergency savings—allowing them to visualize their progress toward each goal more effectively. Some apps even offer high-yield savings accounts or partnerships with financial institutions that enable users to earn interest on their savings.

Investing features are also becoming increasingly common in budgeting apps. Users can link investment accounts or access investment options directly through the app. This integration allows individuals to allocate funds toward investments while still maintaining oversight of their overall budget.

For example, a user might decide to invest a portion of their monthly surplus after expenses are accounted for, ensuring that they are not only saving but also growing their wealth over time.

Tips for Using a Budget App Effectively

To maximize the benefits of using a budgeting app, users should adopt certain best practices that enhance the overall experience and effectiveness of the tool. First and foremost, consistency is key; regularly updating transactions and reviewing budgets ensures that users remain aware of their financial situation at all times. Setting aside time each week or month to review spending habits and adjust budgets accordingly can lead to better financial outcomes.

Another important tip is to customize categories based on personal preferences and lifestyle choices. Many budgeting apps allow users to create custom categories tailored to their unique spending habits. This personalization makes it easier for individuals to track specific areas of interest—such as hobbies or subscriptions—leading to more meaningful insights into their finances.

Additionally, leveraging the goal-setting features within the app can provide motivation and accountability. Users should regularly revisit their financial goals and adjust them as necessary based on changing circumstances or priorities. By celebrating milestones—such as reaching a savings target or paying off debt—users can maintain enthusiasm for their budgeting journey.

Lastly, engaging with community features or forums within the app can provide additional support and inspiration from others on similar financial journeys. Sharing experiences and tips with fellow users fosters a sense of community while offering new perspectives on managing finances effectively. In conclusion, budgeting apps have revolutionized personal finance management by providing accessible tools for tracking expenses, setting goals, and analyzing spending habits.

By understanding the features available in these applications and adopting effective strategies for use, individuals can take control of their financial futures with confidence.

If you are looking for a free budget app to help manage your finances, you may want to check out this article on the best personal finance apps from Valapoint. They provide a comprehensive review of various apps, including Wally, a popular personal finance app. You can also learn more about personal expense tracker apps and how they can help you stay on top of your budget. For more information, visit Valapoint.

FAQs

What is a free budget app?

A free budget app is a mobile application that helps users track their income, expenses, and savings in order to manage their finances effectively.

How does a free budget app work?

A free budget app typically allows users to input their income and expenses, categorize their spending, set savings goals, and track their progress over time. Some apps also offer features such as bill reminders, budgeting tools, and financial reports.

What are the benefits of using a free budget app?

Using a free budget app can help users gain a better understanding of their financial situation, identify areas where they can save money, and stay on track with their financial goals. It can also provide insights into spending habits and help users make more informed financial decisions.

Are free budget apps secure?

Most reputable free budget apps use encryption and other security measures to protect users’ financial information. However, it’s important for users to research and choose a trusted app with a good track record for security.

Can a free budget app help me save money?

Yes, a free budget app can help users save money by providing visibility into their spending habits, setting savings goals, and offering tools to track progress and stay accountable to their financial plans.