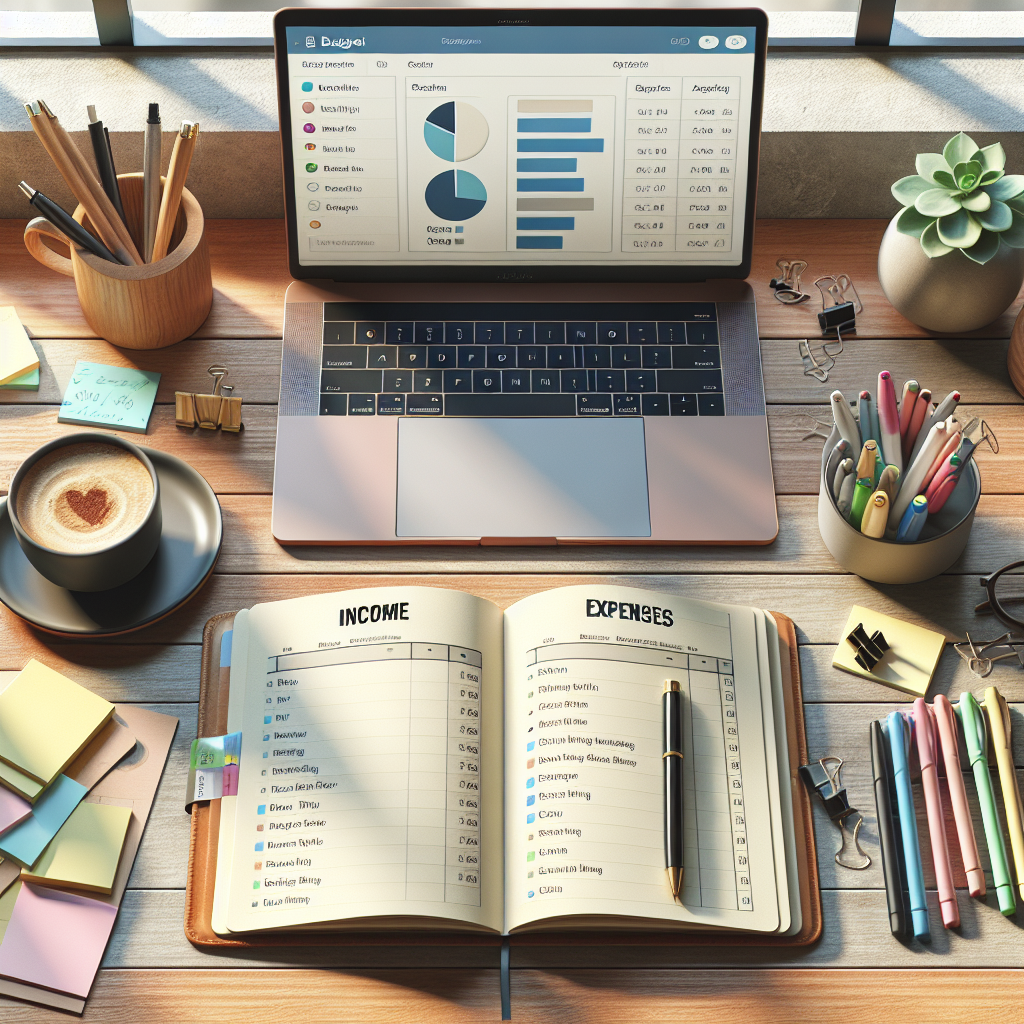

In an increasingly digital world, managing personal finances has become more accessible and efficient, thanks in large part to the advent of budget apps. These applications are designed to help individuals track their income, expenses, and savings goals, providing a structured approach to financial management. With the proliferation of smartphones and tablets, budget apps have emerged as essential tools for anyone looking to gain control over their financial situation.

They offer a user-friendly interface that simplifies the often daunting task of budgeting, making it easier for users to visualize their financial health. The rise of budget apps can be attributed to the growing awareness of the importance of financial literacy. Many people find themselves overwhelmed by bills, debts, and unexpected expenses, leading to stress and anxiety.

Budget apps serve as a solution to this problem by offering a clear framework for tracking spending habits and setting financial goals. By leveraging technology, these apps not only provide insights into spending patterns but also encourage users to adopt better financial habits. As we delve deeper into the benefits and features of budget apps, it becomes evident that they are more than just tools; they are companions on the journey toward financial stability.

Key Takeaways

- Budget apps are digital tools designed to help individuals manage their finances, track expenses, and achieve their financial goals.

- Using budget apps can help individuals gain better control over their finances, reduce overspending, and save money for the future.

- Some of the top budget apps for 2021 include Mint, YNAB (You Need a Budget), PocketGuard, and Goodbudget, each offering unique features and benefits.

- When choosing a budget app, it’s important to consider features such as expense tracking, goal setting, bill reminders, and compatibility with other financial tools.

- To use budget apps effectively, it’s important to set realistic financial goals, track expenses regularly, and make adjustments to spending habits based on the app’s insights. Integrating budget apps with other financial tools can provide a comprehensive view of one’s financial situation and help make informed decisions.

Benefits of Using Budget Apps

Real-Time Financial Insights

One of the primary benefits of using budget apps is the ability to gain real-time insights into one’s financial situation. Traditional budgeting methods often involve manual calculations and paper tracking, which can be tedious and prone to errors. Budget apps automate this process, allowing users to link their bank accounts and credit cards directly to the app.

Comprehensive Transaction Tracking

This integration provides a comprehensive view of all transactions in one place, making it easier to monitor spending and identify areas where adjustments can be made. For instance, if a user notices that they are consistently overspending on dining out, they can take proactive steps to curb that expense.

Setting and Tracking Financial Goals

Another significant advantage of budget apps is their capacity to set and track financial goals. Many apps allow users to create specific savings targets, whether for an emergency fund, a vacation, or a major purchase like a home or car. By breaking down these goals into manageable monthly contributions, users can stay motivated and focused on their objectives. Additionally, some budget apps offer reminders and alerts when users approach their spending limits or when bills are due, helping to prevent late fees and encouraging timely payments.

Fostering Accountability and Discipline

This proactive approach fosters a sense of accountability and discipline in managing finances.

Top Budget Apps for 2021

As of 2021, several budget apps have gained popularity for their unique features and user-friendly interfaces. One standout is Mint, which has been a leader in the budgeting space for years. Mint allows users to connect all their financial accounts in one place, providing a holistic view of their finances.

The app categorizes transactions automatically and offers insights into spending habits, making it easy for users to see where their money is going. Additionally, Mint provides personalized tips for saving money based on individual spending patterns. Another noteworthy app is YNAB (You Need A Budget), which takes a proactive approach to budgeting by encouraging users to allocate every dollar they earn toward specific expenses or savings goals.

YNAB’s methodology is built on four simple rules that promote mindful spending and saving. Users often praise YNAB for its educational resources, which help them develop better budgeting skills over time. The app also offers robust reporting features that allow users to analyze their financial progress over time.

For those seeking a more minimalist approach, PocketGuard is an excellent option. This app focuses on simplicity by showing users how much disposable income they have after accounting for bills, goals, and necessities. PocketGuard’s “In My Pocket” feature helps users understand how much they can spend without jeopardizing their financial goals.

This straightforward approach appeals to individuals who may feel overwhelmed by more complex budgeting systems.

Features to Look for in Budget Apps

| Feature | Description |

|---|---|

| User-friendly interface | An easy-to-navigate interface for smooth user experience |

| Expense tracking | Ability to track and categorize expenses for better budgeting |

| Budget goal setting | Option to set and track budget goals for different categories |

| Bill payment reminders | Feature to set reminders for bill payments to avoid late fees |

| Bank account integration | Ability to link and sync bank accounts for real-time balance updates |

| Financial reports | Generate reports to analyze spending patterns and financial health |

When selecting a budget app, it’s essential to consider various features that can enhance the user experience and effectiveness of the tool. One critical feature is bank account integration, which allows users to link their financial accounts directly to the app. This functionality enables automatic transaction tracking and categorization, reducing the need for manual entry and minimizing errors.

The more accounts an app can integrate with—such as checking accounts, savings accounts, credit cards, and investment accounts—the more comprehensive the financial picture it can provide. Another important feature is customizable budgeting categories. Users have different spending habits and priorities; therefore, an app that allows for personalized categories can significantly enhance its usability.

For example, someone may want to track their spending on groceries separately from dining out or entertainment expenses. Custom categories enable users to tailor their budgeting experience according to their unique financial situations. Additionally, features like goal-setting capabilities and progress tracking can motivate users by visually representing their journey toward achieving specific financial objectives.

How to Choose the Right Budget App for You

Choosing the right budget app involves assessing personal needs and preferences. Start by evaluating your financial goals—are you looking to save for a specific purchase, pay off debt, or simply track your spending? Different apps cater to different objectives; some may focus more on expense tracking while others emphasize goal setting or debt reduction strategies.

Understanding your primary motivation will help narrow down your options. Another factor to consider is the app’s user interface and ease of use. A budget app should be intuitive and straightforward; otherwise, it may become a source of frustration rather than assistance.

Many apps offer free trials or demo versions that allow potential users to explore the interface before committing financially. Additionally, consider whether you prefer a mobile app or a web-based platform; some individuals may find it easier to manage their finances on a larger screen while others appreciate the convenience of mobile access. Lastly, take into account any associated costs with the app.

While many budget apps are free or offer basic features at no charge, some may require subscriptions for premium features or advanced functionalities. Weighing the cost against the potential benefits is crucial in making an informed decision about which app aligns best with your financial management needs.

Tips for Using Budget Apps Effectively

Consistency is Key

Regularly updating transactions and reviewing budgets ensures that users remain aware of their financial situation at all times. Setting aside time each week or month to check in on spending habits can help reinforce accountability and encourage proactive adjustments when necessary.

Set Clear Financial Objectives

Another effective strategy is to utilize the goal-setting features available in many budget apps. By establishing clear financial objectives—such as saving for a vacation or paying off credit card debt—users can create actionable plans that guide their spending decisions. Breaking these goals down into smaller milestones can make them feel more achievable and provide motivation as progress is made.

Enhance Financial Literacy

Engaging with educational resources offered by many budget apps can further enhance financial literacy. Many applications provide articles, videos, or webinars that cover various aspects of personal finance management. By taking advantage of these resources, users can deepen their understanding of budgeting principles and develop skills that extend beyond simply using an app.

Integrating Budget Apps with Other Financial Tools

Integrating budget apps with other financial tools can create a more comprehensive approach to personal finance management. For instance, linking investment accounts or retirement savings plans can provide users with a holistic view of their financial health beyond just day-to-day spending. Some budget apps offer features that allow users to track investments alongside their budgets, enabling them to see how their spending decisions impact long-term financial goals.

Moreover, utilizing additional tools such as expense trackers or bill reminder apps can complement budgeting efforts effectively. For example, an expense tracker can help identify recurring charges that may not be immediately apparent in a budget app’s overview. Similarly, bill reminder tools can ensure that payments are made on time, preventing late fees and maintaining good credit scores.

Collaboration with other financial professionals—such as accountants or financial advisors—can also enhance the budgeting process. Many budget apps allow users to export data in formats that are easily shareable with professionals who can provide tailored advice based on individual circumstances.

Taking Control of Your Finances with Budget Apps

In today’s fast-paced world where financial literacy is paramount, budget apps have emerged as indispensable tools for individuals seeking greater control over their finances. By automating tracking processes and providing real-time insights into spending habits, these applications empower users to make informed decisions about their money management strategies. The benefits of using budget apps extend beyond mere tracking; they foster accountability and encourage proactive goal setting.

As technology continues to evolve, so too will the capabilities of budget apps, offering even more sophisticated features designed to meet diverse user needs. By understanding how to choose the right app and employing effective strategies for usage, individuals can harness the power of these tools to achieve financial stability and success in their personal lives. Ultimately, embracing budget apps represents a significant step toward taking control of one’s finances and building a secure future.

If you are looking for the best free budget tracker app, you should check out Valapoint’s list of recommendations. One of the apps mentioned is Mint, which is known for its user-friendly interface and comprehensive budgeting tools. Another useful article on Valapoint’s website discusses the importance of business expense tracking and offers tips on how to effectively manage your company’s finances. For more information on personal finance apps and how they can help you stay on top of your budget, visit Valapoint’s article on the best personal finance apps.