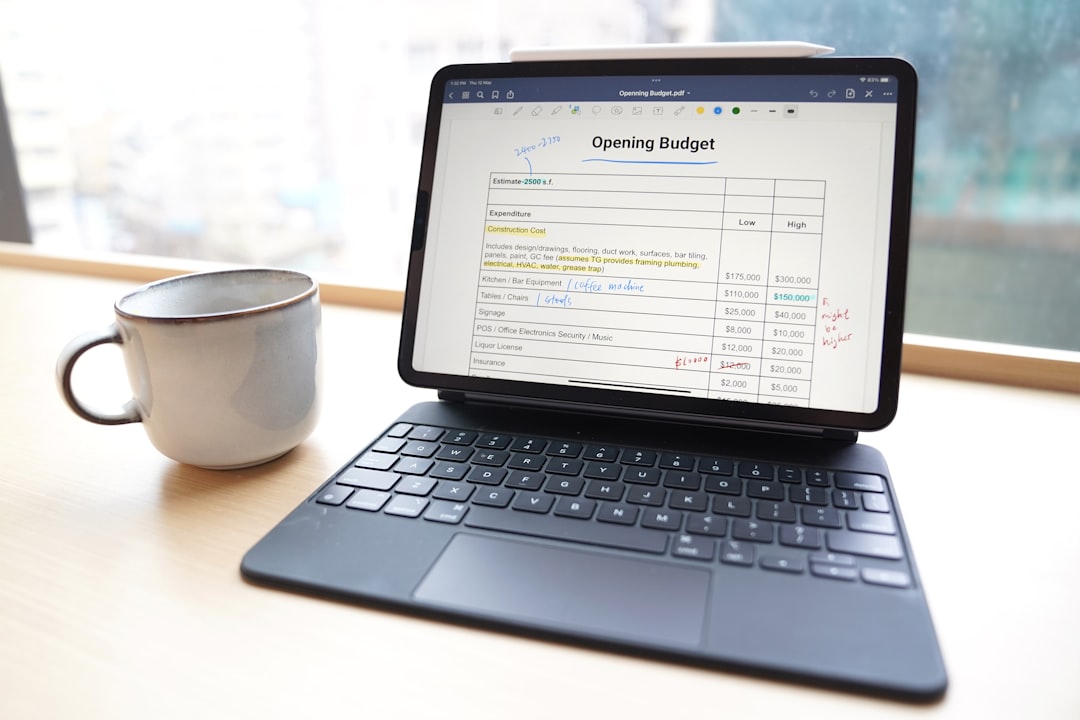

Finding the best free budget tracker app can be a daunting task, with countless options vying for your attention. These apps promise to simplify your finances by offering comprehensive tools for budgeting and expense tracking. The ideal budget tracker app goes beyond mere number crunching; it provides insights into spending habits, offers real-time updates, and helps set financial goals. With the right app, users can transform their smartphones into a powerful financial advisor that’s accessible 24/7.

Whether you’re an individual looking to manage daily expenses or a small business owner seeking to get a better grip on company finances, there’s an app designed to meet your needs. These apps are not just about reflecting past spending but are geared towards shaping a more financially secure future. They prioritize user experience with intuitive interfaces, cater to personalized financial situations, and provide educational resources to foster better money management practices.

Ready to take control of your finances and experience effortless savings? Download Vala today and start managing your budget with ease! As we delve into the features and benefits of the top contenders in the market, we invite you to explore how a well-chosen app can revolutionize the way you handle your finances.

Why A Free Budget Tracker Can Transform Your Finances

Embracing a free budget tracker can be a game-changer for anyone looking to improve their financial wellbeing. These tools are designed to eliminate the complexity and tedium associated with traditional budgeting methods. By offering a clear overview of your income and expenses, a budget tracker can pinpoint where your money is going and help identify potential savings.

One of the key benefits of using a budget tracker is the ability to set and monitor financial goals. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, having a visual representation of your progress can be incredibly motivating. Additionally, many free apps include features such as customizable alerts that notify you when you’re approaching spending limits, thus preventing overspending and encouraging accountability.

The convenience factor of these apps cannot be overstated. With the ability to sync transactions across multiple devices and financial accounts, users gain real-time insights into their financial status, anytime and anywhere. This level of accessibility ensures that financial decision-making is based on the most current information available, which is crucial for maintaining a healthy budget.

Lastly, the educational aspect of budget trackers often goes unnoticed. The best apps not only track finances but also provide users with tips and articles on personal finance. This empowers individuals to make informed choices, understanding the impact of each financial decision. By incorporating a free budget tracker into your daily routine, you’re not just organizing your finances; you’re taking a significant step towards financial literacy and independence.

Exploring User-Friendly Interface In Budget Apps

The user-friendly interface of a budget tracker is pivotal in ensuring that users can navigate and utilize the app effectively. A well-designed interface simplifies the process of budgeting by providing an intuitive layout where users can easily add, categorize, and review transactions with minimal effort.

Key elements of a user-friendly budget app include a clean design with a straightforward dashboard, giving users a quick snapshot of their financial health. This may include displaying current balances, recent transactions, and upcoming bills all in one place. Moreover, interactive charts and graphs offer a visual breakdown of spending habits, making it simpler to digest complex financial data.

Dedicated budget apps often come with features such as automatic categorization of expenses, which saves time and reduces errors in tracking. The ability to customize categories and set up personalized budgets for each ensures that the app aligns with the unique financial situations of different users.

Efficiency is further enhanced through features like one-tap expense entry and voice recognition, both of which expedite the process of recording transactions on-the-go. Additionally, seamless integration with banking and credit card accounts allows for automatic updates, removing the need for manual data entry and reducing the potential for discrepancies.

Ultimately, the effectiveness of a budget tracker is heavily dependent on how approachable it is for the user. By prioritizing a user-friendly interface, budget apps not only make financial management more accessible but also encourage consistent and engaged use, which is essential for achieving long-term financial goals.

Security Features Of Top-Rated Budget Tracker Apps

When it comes to managing personal finances, security is a non-negotiable feature for any budget tracker app. Top-rated budget tracker apps employ robust security measures to protect sensitive user data from unauthorized access and cyber threats.

Advanced encryption technology, such as AES 256-bit, is commonly used to secure data both at rest and in transit. This ensures that all financial information is encoded and can only be accessed by individuals with the correct decryption keys. Additionally, many apps include the option for two-factor authentication (2FA), adding an extra layer of security by requiring a second form of verification before allowing access to the account.

Regular security audits and compliance with industry standards, such as PCI DSS for apps that handle credit card information, are indicators of an app’s commitment to safeguarding user data. Furthermore, privacy policies that clearly outline how user data is collected, used, and shared are essential for maintaining transparency and trust.

Some budget tracker apps go a step further by offering customizable privacy controls, allowing users to decide the level of data sharing that they’re comfortable with. For added peace of mind, features such as automatic account logout after periods of inactivity and the ability to remotely wipe data in the event of a lost or stolen device are also beneficial.

Ultimately, the security features of a budget tracker app are crucial for ensuring that users can manage their finances with confidence. By choosing an app that prioritizes cutting-edge security protocols, users can focus on their financial goals without worrying about the safety of their personal information.

Syncing Across Devices: Budgeting On The Go

In today’s fast-paced world, the ability to manage finances on the move is essential. The best budget tracker free appoffers seamless syncing across multiple devices, ensuring that users can access their financial data anytime, anywhere. This feature enables a consistent budgeting experience whether you’re using a smartphone, tablet, or desktop computer.

Cloud-based technology is at the heart of this functionality, providing real-time updates to all connected devices. As a result, any transaction or budget adjustment made on one device is immediately reflected across all others. This is particularly useful for small businesses and individuals who need to make quick financial decisions while away from the office or home.

Moreover, device syncing allows multiple users to collaborate on a single budget. Families or business partners can track shared expenses and incomes collectively, which simplifies managing joint financial goals and responsibilities. It’s imperative to ensure that the app chosen has a robust mechanism to handle such collaborative efforts while maintaining individual privacy and security settings.

User experience is also enhanced by syncing capabilities, as they eliminate the need for duplicate entries and reduce the chance of errors. With the assurance that all financial data is up to date across all platforms, users can enjoy a convenient and stress-free approach to budgeting. The peace of mind that comes with knowing your financial overview is accurate and accessible, regardless of your location, is invaluable for effective money management.

The Verdict: Unveiling The Best Free Budget Tracker App

After careful analysis and comparison of features, user interfaces, and customer reviews, the search for the best budget tracker free app concludes. The ideal budget tracker app offers a combination of ease of use, comprehensive budgeting tools, and the ability to customize according to individual or business needs. And while many apps on the market claim to be the best, one stands out from the rest: Vala.

Vala’s savings management platform is not just another budgeting tool; it’s a comprehensive financial assistant that simplifies expense tracking and budgeting. Vala’s user-friendly interface and advanced features are designed to empower users to take control of their finances without feeling overwhelmed.

From creating detailed budgets to generating insightful reports, Vala offers a wide range of functionalities that are both intuitive and powerful. The app’s real-time tracking system ensures that users are always informed about their financial status, which is critical for making informed financial decisions.

Significantly, Vala maintains a strong commitment to transparency, reliability, and customer-centricity. These core values are evident in every aspect of the app, from its straightforward layout to its responsive customer support. Choosing Vala means choosing a partner that is invested in your financial well-being.

Ready to take control of your finances and experience effortless savings? Download Vala today and start managing your budget with ease!