In an increasingly digital world, managing personal finances has become more accessible and efficient, thanks in large part to budgeting apps. These applications serve as powerful tools that help individuals track their income, expenses, and savings goals in real-time. With the rise of smartphones and the growing reliance on technology for everyday tasks, budgeting apps have emerged as essential companions for anyone looking to take control of their financial health.

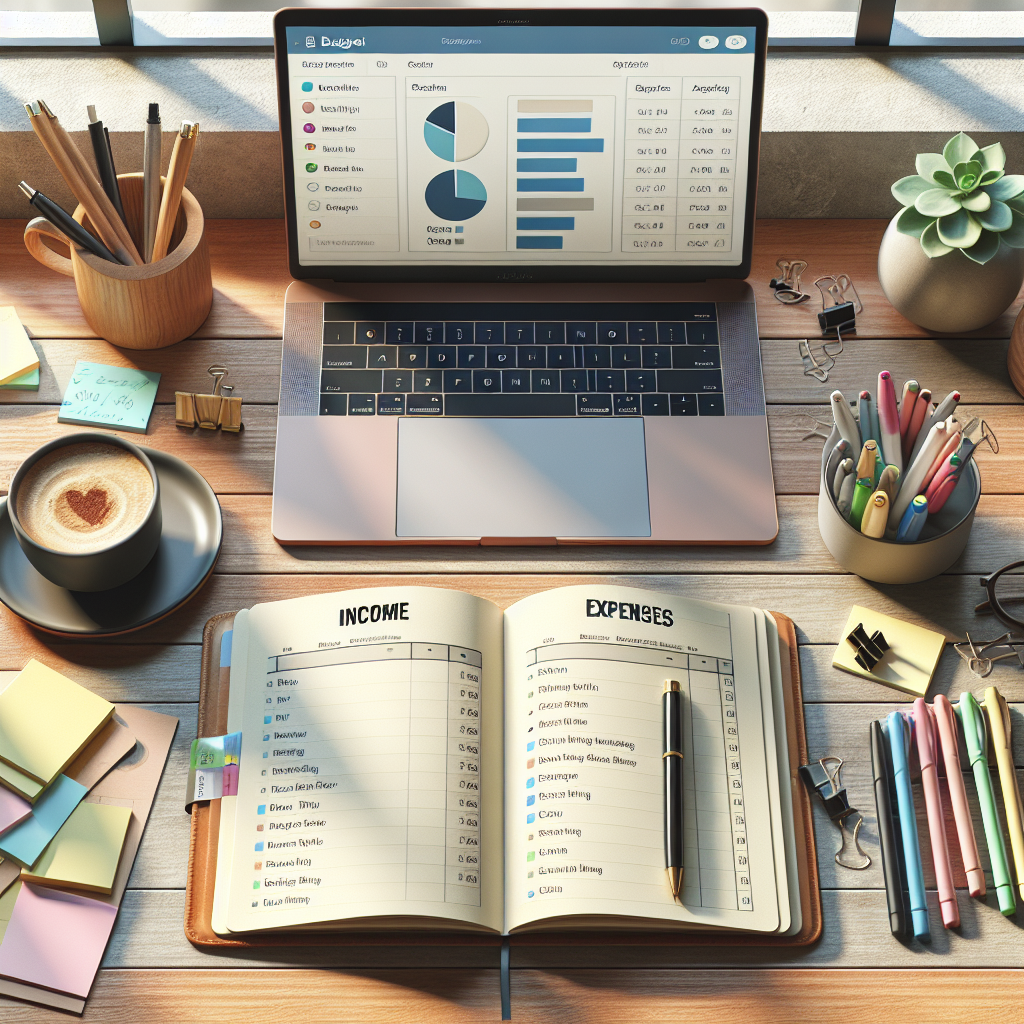

The appeal of budgeting apps lies not only in their convenience but also in their ability to provide insights into spending habits. By categorizing expenses and visualizing financial data through graphs and charts, these apps empower users to make informed decisions about their money.

Whether you are a student managing limited funds, a professional saving for a major purchase, or a family planning for future expenses, budgeting apps can cater to diverse financial needs. As we delve deeper into the features and functionalities of these applications, it becomes clear that they are more than just digital ledgers; they are comprehensive financial management tools designed to foster better money habits.

Key Takeaways

- Budgeting apps are a useful tool for managing personal finances and tracking expenses.

- Key features to look for in a budgeting app include customizable budget categories, goal setting, and expense tracking.

- Maximize Savings Now is a top budgeting app for iPhone, offering user-friendly interface and robust features.

- Setting up and using a budgeting app involves linking bank accounts, categorizing expenses, and setting budget limits.

- Tips for getting the most out of your budgeting app include regularly reviewing your budget, setting achievable goals, and utilizing the app’s reporting features.

Key Features to Look for in a Budgeting App

When selecting a budgeting app, it is crucial to consider several key features that can significantly enhance your budgeting experience. One of the most important aspects is the ability to sync with your bank accounts and credit cards. This feature allows the app to automatically import transactions, reducing the manual entry required and ensuring that your budget reflects your current financial situation accurately.

Automatic syncing not only saves time but also minimizes the risk of errors that can occur with manual data entry. Another essential feature is customizable budgeting categories. A good budgeting app should allow users to create and modify categories that align with their unique spending habits.

For instance, someone who frequently dines out may want a separate category for restaurant expenses, while another user might prioritize savings or debt repayment.

Additionally, look for apps that offer goal-setting capabilities, allowing you to set specific savings targets or debt repayment timelines.

This feature can motivate users by providing a clear path toward achieving their financial objectives.

Top Budgeting App for iPhone: Maximize Savings Now

Among the myriad of budgeting apps available for iPhone users, one standout option is YNAB (You Need A Budget). YNAB has gained a loyal following due to its unique approach to budgeting, which emphasizes proactive financial management rather than reactive tracking. The app encourages users to allocate every dollar they earn to specific categories, ensuring that every cent has a purpose.

This method not only helps users avoid overspending but also fosters a mindset of intentionality when it comes to finances. YNAB’s user-friendly interface is another reason for its popularity. The app provides a visually appealing dashboard that displays your budget at a glance, making it easy to see how much money is available in each category.

Additionally, YNAB offers robust educational resources, including webinars and tutorials, which help users understand the principles of effective budgeting. This educational component sets YNAB apart from many other apps, as it empowers users with knowledge that can lead to long-term financial success. With its combination of practical features and educational support, YNAB stands out as an excellent choice for iPhone users looking to maximize their savings.

How to Set Up and Use the Budgeting App

| Metrics | Data |

|---|---|

| Number of Downloads | 10,000 |

| User Ratings | 4.5/5 |

| Active Users | 5,000 |

| Features | Expense Tracking, Budget Planning, Bill Reminders |

Setting up a budgeting app like YNAB is a straightforward process that can be completed in just a few steps. First, users need to create an account and link their bank accounts or credit cards for automatic transaction syncing. This initial setup is crucial as it allows the app to pull in real-time data about your spending habits.

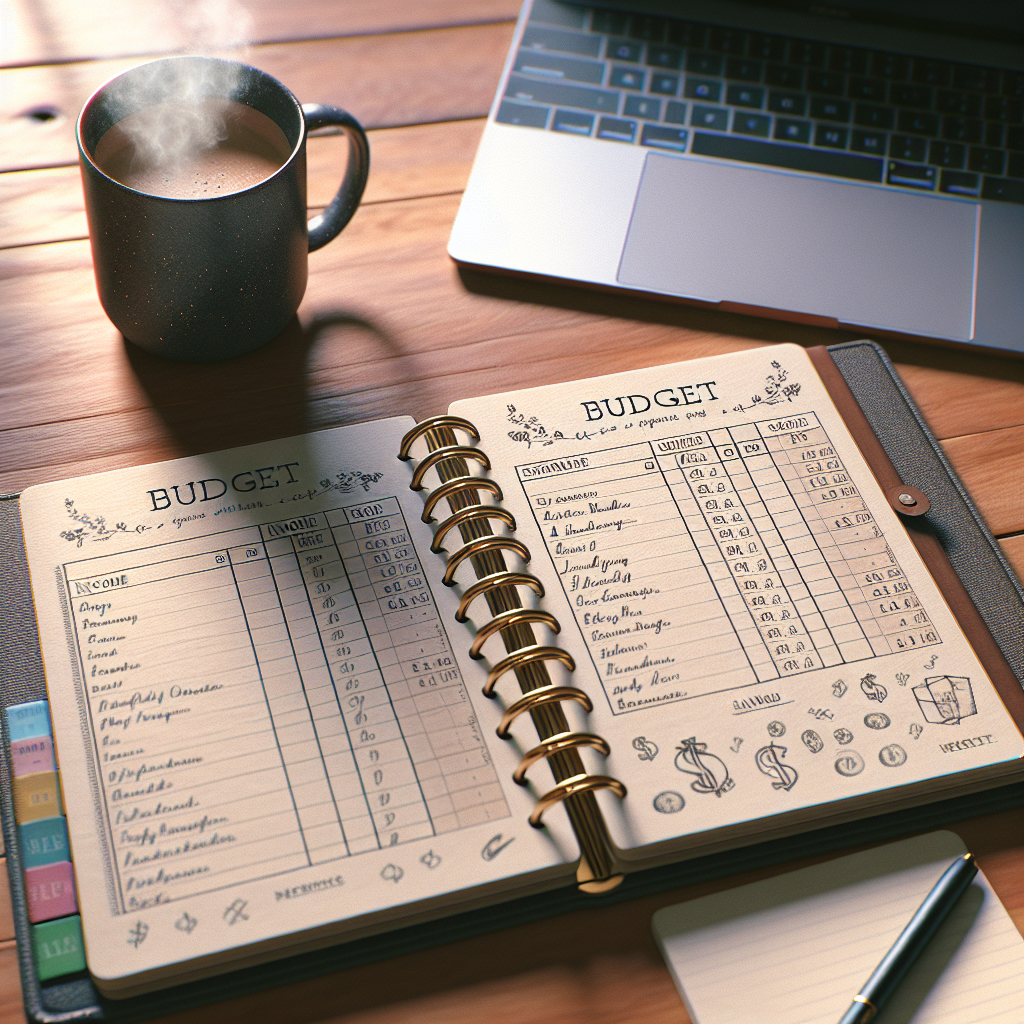

Once linked, the app will categorize past transactions automatically, giving you a clear picture of where your money has been going. After linking accounts, the next step involves creating a budget based on your income and expenses. YNAB encourages users to start by determining their monthly income and then allocating funds to various categories such as housing, groceries, entertainment, and savings.

The app’s “zero-based budgeting” approach means that every dollar should be assigned a job until there is no money left unallocated. This method not only helps in tracking spending but also instills discipline in financial management. As you continue using the app, you can adjust categories and amounts based on your evolving financial situation, ensuring that your budget remains relevant and effective.

Tips and Tricks for Getting the Most Out of Your Budgeting App

To truly harness the power of a budgeting app like YNAB, users should adopt certain strategies that enhance their budgeting experience. One effective tip is to regularly review and adjust your budget based on actual spending patterns. At the end of each month or week, take time to analyze where you overspent or underspent in various categories.

This reflection allows you to make informed adjustments for the upcoming period, ensuring that your budget remains realistic and achievable. Another valuable trick is to utilize the goal-setting feature within the app effectively. Setting specific savings goals—whether for an emergency fund, vacation, or major purchase—can provide motivation and direction in your budgeting efforts.

Break down larger goals into smaller milestones to make them feel more attainable. For instance, if you aim to save $1,200 for a vacation in one year, consider setting aside $100 each month. By tracking your progress toward these goals within the app, you can celebrate small victories along the way, reinforcing positive financial behaviors.

Tracking Your Savings and Progress

Tracking savings and progress is a fundamental aspect of effective budgeting that many users overlook. A well-designed budgeting app will provide tools for monitoring not just spending but also savings growth over time. In YNAB, users can set up specific savings goals and track their progress visually through graphs and charts.

This visual representation can be incredibly motivating; seeing your savings grow can encourage you to stick to your budget and continue making smart financial choices. Moreover, regular check-ins on your savings progress can help identify areas where you might be able to cut back further or reallocate funds more effectively. For example, if you notice that you consistently have surplus funds in one category while struggling in another, it may be time to adjust your budget accordingly.

By actively engaging with your financial data and tracking your progress over time, you can develop a deeper understanding of your financial habits and make informed decisions that align with your long-term goals.

Integrating Your Budgeting App with Other Financial Tools

To maximize the effectiveness of a budgeting app like YNAB, consider integrating it with other financial tools that complement its functionality. Many users find it beneficial to connect their budgeting app with investment platforms or savings accounts that offer higher interest rates. This integration allows for a holistic view of one’s finances by consolidating all financial data into one accessible location.

Additionally, some budgeting apps offer compatibility with expense tracking tools or bill management services. For instance, integrating with an expense tracker can provide deeper insights into spending patterns beyond what the budgeting app alone offers. Similarly, linking with bill management services can help ensure that all bills are paid on time, preventing late fees and maintaining good credit scores.

By leveraging these integrations, users can create a comprehensive financial ecosystem that enhances their overall money management strategy.

Take Control of Your Finances with the Right Budgeting App

In today’s fast-paced world where financial literacy is more important than ever, utilizing a budgeting app can be a game-changer for individuals seeking control over their finances. With features designed to simplify tracking income and expenses while providing valuable insights into spending habits, these apps empower users to make informed decisions about their money. By choosing an app that aligns with personal financial goals and employing effective strategies for its use, anyone can cultivate better money management practices.

As technology continues to evolve, so too will the capabilities of budgeting apps. Staying informed about new features and best practices will ensure that users can adapt their strategies as needed. Ultimately, taking control of one’s finances is not just about tracking numbers; it’s about fostering a mindset of intentionality and discipline that leads to long-term financial well-being.

With the right budgeting app in hand, individuals can embark on a journey toward greater financial stability and success.

If you are looking for the best budgeting app on iPhone, you may want to check out the Vala app by Valapoint. This app offers a user-friendly interface and a variety of features to help you track your expenses and manage your finances effectively. In addition, you can also consider using a digital budget planner like the one mentioned in this article to further enhance your budgeting experience.