In an era where financial literacy is more crucial than ever, budgeting apps have emerged as indispensable tools for managing personal finances. With the proliferation of smartphones, particularly Android devices, these applications have made it easier for users to track their spending, set financial goals, and ultimately gain control over their financial lives. The convenience of having a budgeting tool at one’s fingertips allows individuals to monitor their expenses in real-time, making it simpler to adhere to budgets and make informed financial decisions.

The rise of budgeting apps can be attributed to the increasing complexity of personal finance management. Traditional methods, such as pen-and-paper budgeting or spreadsheets, often fall short in terms of accessibility and ease of use. Budgeting apps not only streamline the process but also offer features that can automate many aspects of financial tracking.

From syncing bank accounts to providing visual representations of spending habits, these apps cater to a wide range of users, from those just starting their financial journey to seasoned budgeters looking for advanced tools.

Key Takeaways

- Budgeting apps for Android are a convenient way to track and manage your finances on the go.

- When choosing a budgeting app, look for features such as expense tracking, budget goal setting, bill reminders, and customizable categories.

- Some of the best free budgeting apps for Android include Mint, Goodbudget, and Wallet.

- Paid budgeting apps like YNAB (You Need A Budget) and PocketGuard offer advanced features and personalized support for a fee.

- To choose the right budgeting app for your needs, consider your financial goals, spending habits, and the app’s user interface and compatibility with your banking institutions.

Features to Look for in a Budgeting App

When selecting a budgeting app, several key features should be considered to ensure it meets your financial management needs. One of the most important aspects is the ability to sync with bank accounts and credit cards. This feature allows users to automatically import transactions, reducing the manual entry required and providing a more accurate picture of their financial situation.

Real-time updates on spending can help users stay within their budgets and identify areas where they may be overspending. Another critical feature is the ability to categorize expenses. A good budgeting app should allow users to create custom categories or use predefined ones to classify their spending.

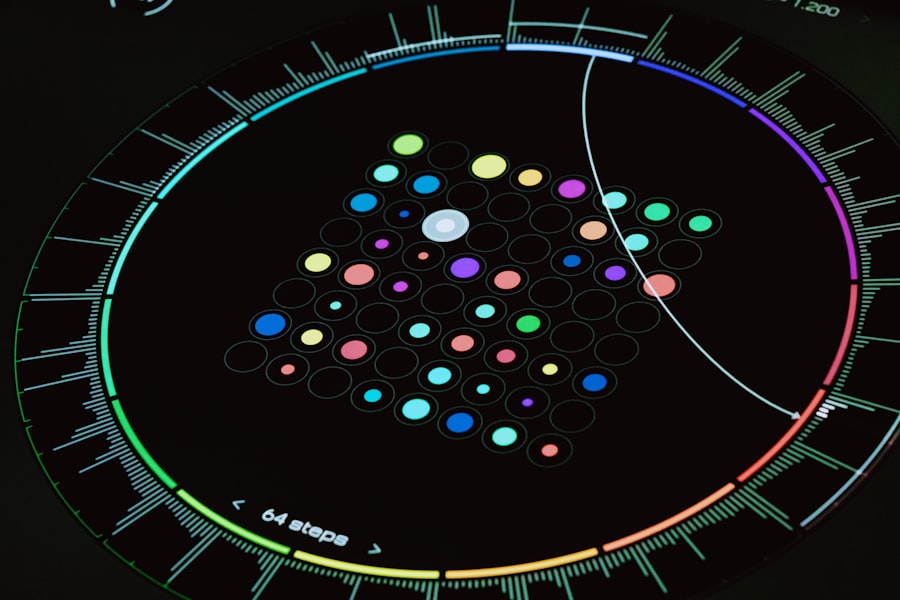

This categorization helps in understanding where money is going and can highlight patterns that may need addressing. Additionally, features such as goal setting and tracking can motivate users to save for specific objectives, whether it’s a vacation, a new car, or an emergency fund. The ability to generate reports and visualizations, such as pie charts or bar graphs, can also enhance understanding and engagement with one’s financial data.

Best Free Budgeting Apps for Android

For those who are hesitant to invest in a paid budgeting app, there are several excellent free options available on the Android platform. One standout is Mint, which has gained popularity for its user-friendly interface and comprehensive features. Mint allows users to link their bank accounts and credit cards, automatically categorizing transactions and providing insights into spending habits.

The app also offers budgeting tools that help users set limits on various categories and alerts them when they approach those limits. Another noteworthy free app is YNAB (You Need A Budget), which operates on a unique philosophy that encourages users to allocate every dollar they earn towards specific expenses or savings goals. While YNAB offers a free trial, it does require a subscription after that period.

However, its robust features, including goal tracking and detailed reporting, make it a valuable tool for those serious about budgeting. Additionally, PocketGuard simplifies the budgeting process by showing users how much disposable income they have after accounting for bills, goals, and necessities, making it easier to manage day-to-day spending.

Best Paid Budgeting Apps for Android

| App Name | Price | Features | User Ratings |

|---|---|---|---|

| YNAB (You Need A Budget) | 84/year | Goal Tracking, Bank Syncing, Debt Paydown | 4.7/5 |

| Goodbudget | 6/month | Envelope Budgeting, Expense Tracking, Sync Across Devices | 4.5/5 |

| Wallet – Finance Tracker and Budget Planner | 34.99/year | Expense Tracking, Bank Syncing, Bill Reminder | 4.6/5 |

While free budgeting apps can be quite effective, some users may find that paid options offer additional features that justify the cost. One of the leading paid budgeting apps is EveryDollar, which was developed by financial expert Dave Ramsey. EveryDollar employs a zero-based budgeting approach, encouraging users to allocate every dollar they earn towards expenses or savings.

The app’s intuitive design makes it easy to create monthly budgets and track spending against those budgets. Users can opt for a free version or subscribe to the premium version for added features like bank syncing. Another excellent paid option is GoodBudget, which operates on a digital envelope system.

Users can create virtual envelopes for different spending categories and allocate funds accordingly. This method helps users visualize their budgets and prevents overspending in any category. GoodBudget offers both free and paid versions; the paid version provides additional envelopes and features that enhance the overall budgeting experience.

The app’s focus on envelope budgeting appeals to those who prefer a more tactile approach to managing their finances.

How to Choose the Right Budgeting App for Your Needs

Choosing the right budgeting app involves assessing your personal financial situation and understanding what features are most important to you. Start by identifying your primary goals: Are you looking to track daily expenses, save for a specific goal, or manage debt? Different apps cater to different needs; for instance, if you want detailed reporting and analytics, you might lean towards an app like YNAB or Mint.

Conversely, if you prefer simplicity and ease of use, an app like EveryDollar may be more suitable. Additionally, consider your comfort level with technology. Some apps may have a steeper learning curve than others; therefore, it’s essential to choose one that aligns with your tech-savviness.

Reading user reviews and exploring app demos can provide insight into how intuitive an app is before committing to it. Lastly, think about whether you prefer a free or paid solution; while free apps can be effective, paid options often come with enhanced features that may be worth the investment depending on your financial goals.

Tips for Using Budgeting Apps Effectively

To maximize the benefits of budgeting apps, users should adopt certain best practices that enhance their effectiveness. First and foremost, consistency is key; regularly updating your budget and tracking expenses will provide a clearer picture of your financial health. Setting aside time each week or month to review your budget can help you stay accountable and make necessary adjustments based on changing circumstances.

Another useful tip is to take advantage of the app’s features fully. Many budgeting apps offer educational resources or community forums where users can share tips and strategies. Engaging with these resources can provide valuable insights into effective budgeting practices.

Additionally, setting realistic goals within the app can help maintain motivation; whether it’s saving for a vacation or paying off debt, having tangible objectives can make the budgeting process more rewarding.

Reviews of Top Budgeting Apps for Android

Mint has consistently received high praise from users for its comprehensive features and ease of use. Users appreciate its ability to sync with multiple accounts and provide real-time updates on spending habits. The visualizations offered by Mint help users quickly grasp their financial situation at a glance.

However, some users have expressed concerns about privacy issues related to data sharing. YNAB has garnered a loyal following due to its unique approach to budgeting that emphasizes proactive planning rather than reactive tracking. Users often highlight its educational resources as a significant benefit, helping them develop better financial habits over time.

However, some find the subscription fee a barrier despite its robust offerings. EveryDollar has been well-received for its straightforward interface and zero-based budgeting approach. Users enjoy its simplicity but note that the free version lacks bank syncing capabilities, which can be inconvenient for those who prefer automated tracking.

GoodBudget stands out for its envelope budgeting system, appealing to those who appreciate a more hands-on approach to managing finances. Users enjoy the visual aspect of envelope allocation but may find the lack of bank syncing limiting compared to other apps.

Making the Most of Your Budgeting App

In today’s fast-paced world, leveraging technology through budgeting apps can significantly enhance personal finance management. By understanding the various features available in these applications and selecting one that aligns with individual needs and preferences, users can take control of their financial futures. Whether opting for a free or paid solution, the key lies in consistent usage and engagement with the app’s functionalities.

Ultimately, budgeting apps serve as powerful allies in achieving financial goals—be it saving for a dream vacation or paying off debt—by providing clarity and structure in managing finances effectively. With dedication and the right tools at hand, anyone can navigate their financial landscape with confidence and purpose.