Discover how the Reddit budget tracker can simplify savings and enhance your financial management skills for a better future. Navigating the world of personal finance can be challenging, but with the right tools, it becomes significantly more manageable. **Reddit**, a platform renowned for its diverse communities and user-generated content, has emerged as a treasure trove for financial advice and tools, particularly when it comes to

budget tracking. Within its various subreddits, users share insights, experiences, and recommendations on the best budget trackers that can help you take control of your financial journey.

In this guide, we delve into the essentials of using Reddit as a resource for budget tracking. From understanding **why Reddit’s communal wisdom is invaluable** to discovering which budget trackers are frequently recommended, you’ll gain a comprehensive view of how to leverage this platform for your savings goals. Users often find that the collaborative nature of Reddit communities offers unique, crowd-sourced solutions that aren’t available elsewhere, making it an indispensable tool for modern savers.

Whether you’re a seasoned budgeter or just starting out, exploring Reddit for budget trackers can provide you with tailored advice that suits your specific needs. The community-driven discussions allow for an exchange of practical tips and tools that can refine your budgeting strategies. So, are you ready to take control of your finances and experience effortless savings? Download Vala today and start managing your budget with ease! Visit Vala to embark on your journey towards financial empowerment.

Benefits Of Using Reddit For Budgeting

One of the most significant benefits of using **Reddit for budgeting** is the access to a vast and diverse community of financially-savvy individuals. These communities, often found in subreddits like r/personalfinance and r/budget, provide a platform where users can share real-life experiences and advice. Such **crowd-sourced insights** offer a unique advantage, as they are derived from a wide range of perspectives and financial situations, helping you find solutions that are practical and relatable.

Another noteworthy benefit is the **up-to-date information** available on Reddit. Financial products and strategies are constantly evolving, and Reddit’s active user base ensures that the latest tips, tools, and resources are frequently discussed. This dynamic environment allows users to stay informed about the newest budgeting apps, innovative strategies, and potential pitfalls to avoid.

Moreover, Reddit’s anonymous nature encourages open and honest discussions. Users feel comfortable sharing their successes and failures, creating a learning environment where you can gain insights from both. This transparency fosters a sense of community and support, which can be incredibly motivating for those who may feel overwhelmed by their financial challenges.

Lastly, Reddit’s **interactive format** allows for immediate feedback and engagement. If you have questions or need clarification, there’s a good chance someone in the community will respond with useful information. This real-time interaction can be invaluable in refining your budgeting approach and ensuring you’re on the right track.

Popular Reddit Budget Tracker Tools

When it comes to budgeting, Reddit users often highlight a variety of tools that have proven effective for managing personal finances. Among these, **YNAB (You Need A Budget)** is frequently mentioned as a top choice. This tool is praised for its proactive approach to budgeting, encouraging users to assign every dollar a job, which promotes intentional spending and saving habits.

Another popular tool is **Mint**, which is well-known for its comprehensive features that include expense tracking, bill reminders, and credit score monitoring. Reddit users appreciate its user-friendly interface and the ability to aggregate all financial accounts in one place, making it easier to keep track of spending and savings goals.

For those who prefer a minimalist approach, **EveryDollar** is often recommended. Created by financial guru Dave Ramsey, this tool focuses on simplicity and zero-based budgeting, allowing users to plan expenses down to the last penny. Redditors praise its ease of use and effectiveness in helping them stick to a budget.

**PocketGuard** is another tool that has gained traction among Reddit users. It simplifies the budgeting process by showing how much disposable income remains after accounting for bills, goals, and necessities. This feature helps users avoid overspending and make informed financial decisions.

Lastly, some Redditors advocate for **Excel or Google Sheets** for those who prefer more control and customization over their budgeting process. These spreadsheet programs allow users to create personalized budgeting templates that can be tailored to individual needs, offering flexibility and precision that some find unmatched by other tools.

How To Choose The Right Budget Tracker

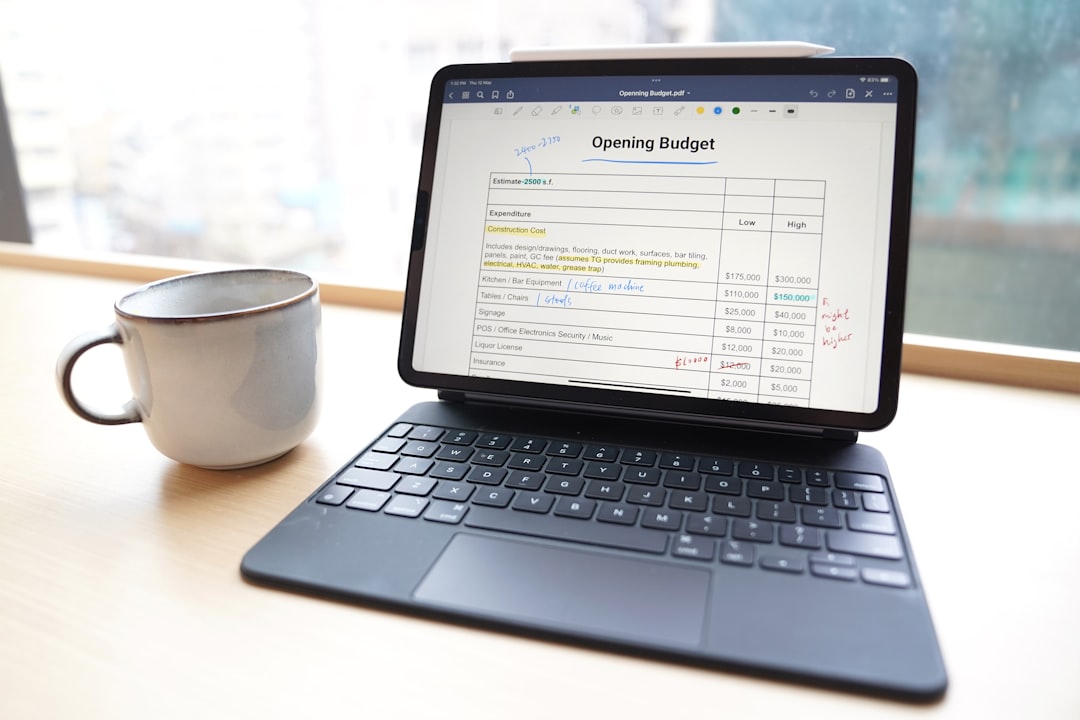

Selecting the right budget tracker is crucial for effective financial management. The first step is to **identify your specific needs**. Are you looking to simply track expenses, or do you need a comprehensive tool that integrates with your bank accounts and offers financial insights? Understanding your requirements will help narrow down the choices.

Consider the **ease of use** and interface of the budget tracker. A tool with a user-friendly design can make the budgeting process less daunting and more enjoyable. Look for trackers that offer intuitive navigation, clear data visualization, and simple input methods. This is especially important if technology isn’t your strong suit.

**Compatibility** is another critical factor. Ensure the budget tracker is compatible with your devices, whether it’s a smartphone, tablet, or desktop. Many popular tools offer cross-platform functionality, which can be a significant advantage if you want to manage your finances on the go.

Another consideration is the level of **customization** and flexibility offered by the budget tracker. Some users prefer predefined categories, while others might want the ability to create custom categories and budgets. The right tracker should cater to your personal preferences and financial goals.

Security is paramount when dealing with financial data. Opt for a budget tracker that prioritizes **data protection** with robust security measures such as encryption and two-factor authentication. This ensures that your sensitive information remains safe from unauthorized access.

Lastly, consider the **cost** of the budget tracker. While some tools are free, others might require a subscription fee. Weigh the features and benefits against the cost to determine if it’s a worthwhile investment for your financial health.

Tips For Effective Budget Management

Effective budget management is key to achieving financial stability and growth. One of the most **important tips** is to set clear and realistic financial goals. Whether it’s saving for a vacation, building an emergency fund, or paying off debt, having specific goals can provide motivation and direction.

Start by **categorizing your expenses** to get a clear picture of where your money is going. This can be done using a budget tracker, which helps in identifying areas where you can cut back. Common categories include housing, utilities, groceries, entertainment, and savings. Regularly reviewing these categories allows you to make informed adjustments.

**Automate your savings** wherever possible. Setting up automatic transfers to your savings account ensures that a portion of your income is saved before you even have a chance to spend it. This “pay yourself first” approach is an effective way to build your savings effortlessly.

Avoid the temptation of impulse buying by practicing **mindful spending**. Before making a purchase, consider if it’s a need or a want. Implementing a 24-hour rule—waiting a day before buying non-essential items—can significantly reduce impulse purchases.

Tracking your spending is crucial, but it’s equally important to **review and adjust your budget** regularly. Life circumstances and financial goals evolve, so your budget should be flexible enough to adapt to these changes. Set aside time each month to review your progress and make necessary adjustments.

Lastly, don’t forget to **celebrate small victories**. Achieving financial goals, no matter how minor, deserves recognition. Celebrating these milestones can boost morale and keep you motivated on your financial journey.

Integrating Budget Trackers With Vala

Integrating budget trackers with Vala can significantly enhance your financial management experience, making it even more seamless and effective. As a **cutting-edge savings management platform**, Vala offers personalized solutions that align with your unique financial goals. By synchronizing your preferred budget tracker with Vala, you can enjoy a holistic view of your finances all in one place.

To begin with, choose a budget tracker that complements Vala’s features. Many users find success with popular apps and tools discussed on Reddit, which provide advanced tracking capabilities and user-friendly interfaces. These tools often allow for easy import and export of data, ensuring that your financial information is always up-to-date across platforms.

Once you’ve selected a compatible budget tracker, the next step is to **link it to Vala**. This integration allows you to automatically sync transactions and financial data, eliminating the hassle of manual entry. It streamlines your budgeting process, giving you more time to focus on analyzing and optimizing your spending habits.

**Custom notifications** can be set up to alert you of spending limits, upcoming bills, and savings milestones, ensuring you stay on track with your financial plan. This proactive approach helps in avoiding unnecessary debt and maintaining a healthy cash flow.

Moreover, Vala’s platform is designed to offer insights and suggestions based on your spending patterns, empowering you to make informed financial decisions. By leveraging these insights, you can refine your budget and maximize your savings potential.

**Ready to take control of your finances and experience effortless savings?** Download Vala today and start managing your budget with ease!