Expense tracking is a fundamental practice for anyone looking to gain control over their financial situation. In an age where digital transactions dominate, the ability to monitor spending habits has never been more critical. Expense tracking involves recording and categorizing expenditures to provide insights into where money is going, enabling individuals to make informed financial decisions.

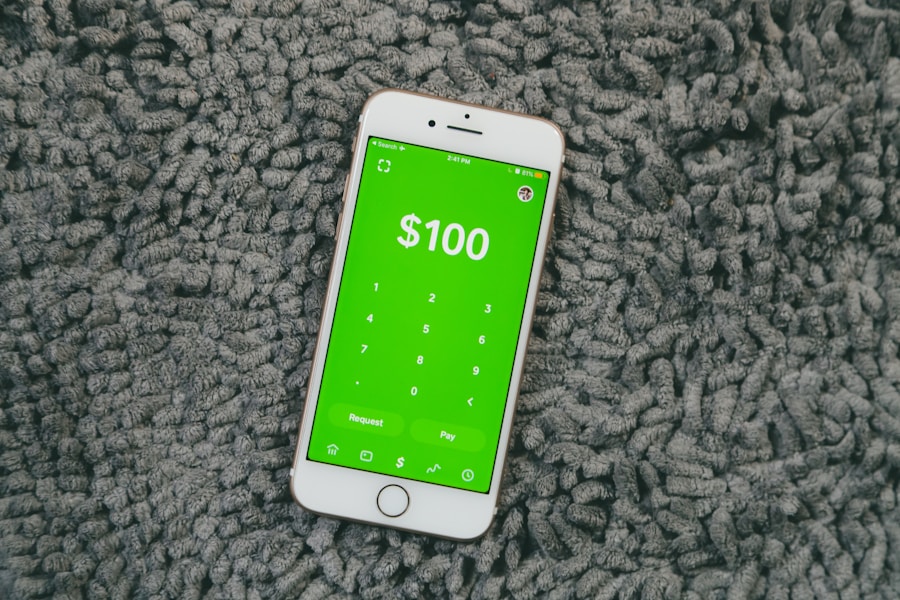

This practice can be as simple as jotting down daily expenses in a notebook or as sophisticated as utilizing advanced software applications designed specifically for this purpose. The rise of technology has led to the development of numerous expense tracker apps, particularly for mobile devices. These applications not only simplify the process of tracking expenses but also offer a range of features that can enhance financial literacy and budgeting skills.

With the convenience of smartphones, users can access their financial data anytime and anywhere, making it easier to stay on top of their spending. As we delve deeper into the benefits and features of these apps, it becomes clear that effective expense tracking is an essential component of personal finance management.

Key Takeaways

- Tracking expenses is essential for managing personal finances and achieving financial goals.

- Using an expense tracker app can help individuals gain better control over their spending and budgeting.

- When looking for a free iOS expense tracker app, it’s important to consider features such as ease of use, customization, and data security.

- Some top free iOS expense tracker app options include Mint, PocketGuard, and Wally.

- To choose the best expense tracker app, consider your specific needs, such as budgeting, bill tracking, and investment tracking.

Benefits of Using an Expense Tracker App

Utilizing an expense tracker app offers a multitude of advantages that can significantly improve one’s financial health. One of the primary benefits is the ability to visualize spending patterns over time. By categorizing expenses—such as groceries, entertainment, and utilities—users can quickly identify areas where they may be overspending.

This awareness can lead to more mindful spending habits and ultimately help individuals save money. For instance, if a user notices that they are consistently spending a large portion of their income on dining out, they may choose to cook at home more often, thereby reducing their overall expenses. Another significant benefit is the ease of budgeting that comes with using an expense tracker app.

Many of these applications allow users to set budget limits for different categories and provide alerts when they are nearing those limits. This feature encourages users to stick to their financial goals and can prevent overspending. Additionally, some apps offer insights and recommendations based on spending habits, helping users make better financial decisions.

For example, if an app detects that a user frequently exceeds their budget for entertainment, it might suggest alternative activities that are more cost-effective, fostering a more sustainable lifestyle.

Features to Look for in a Free iOS Expense Tracker App

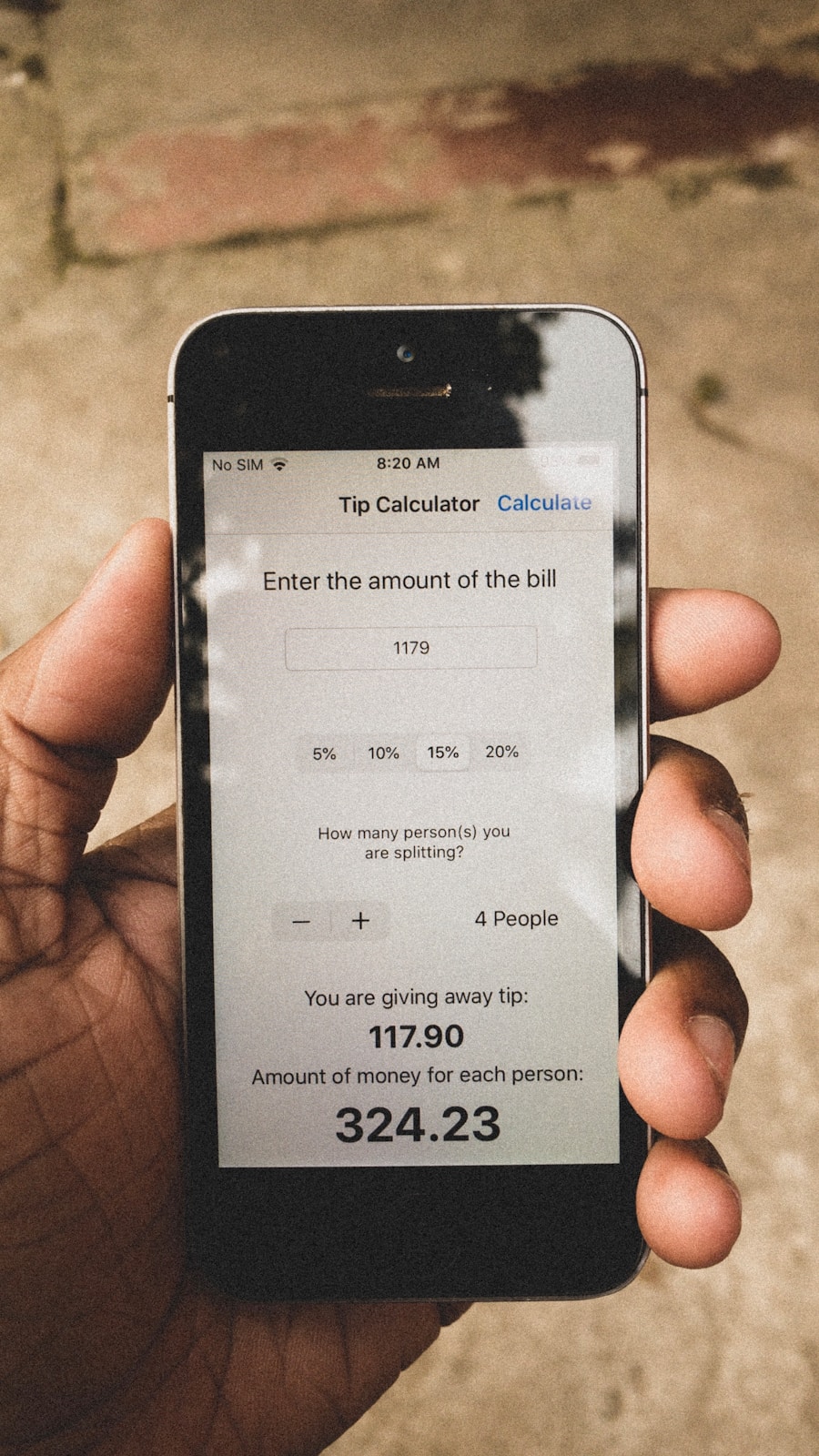

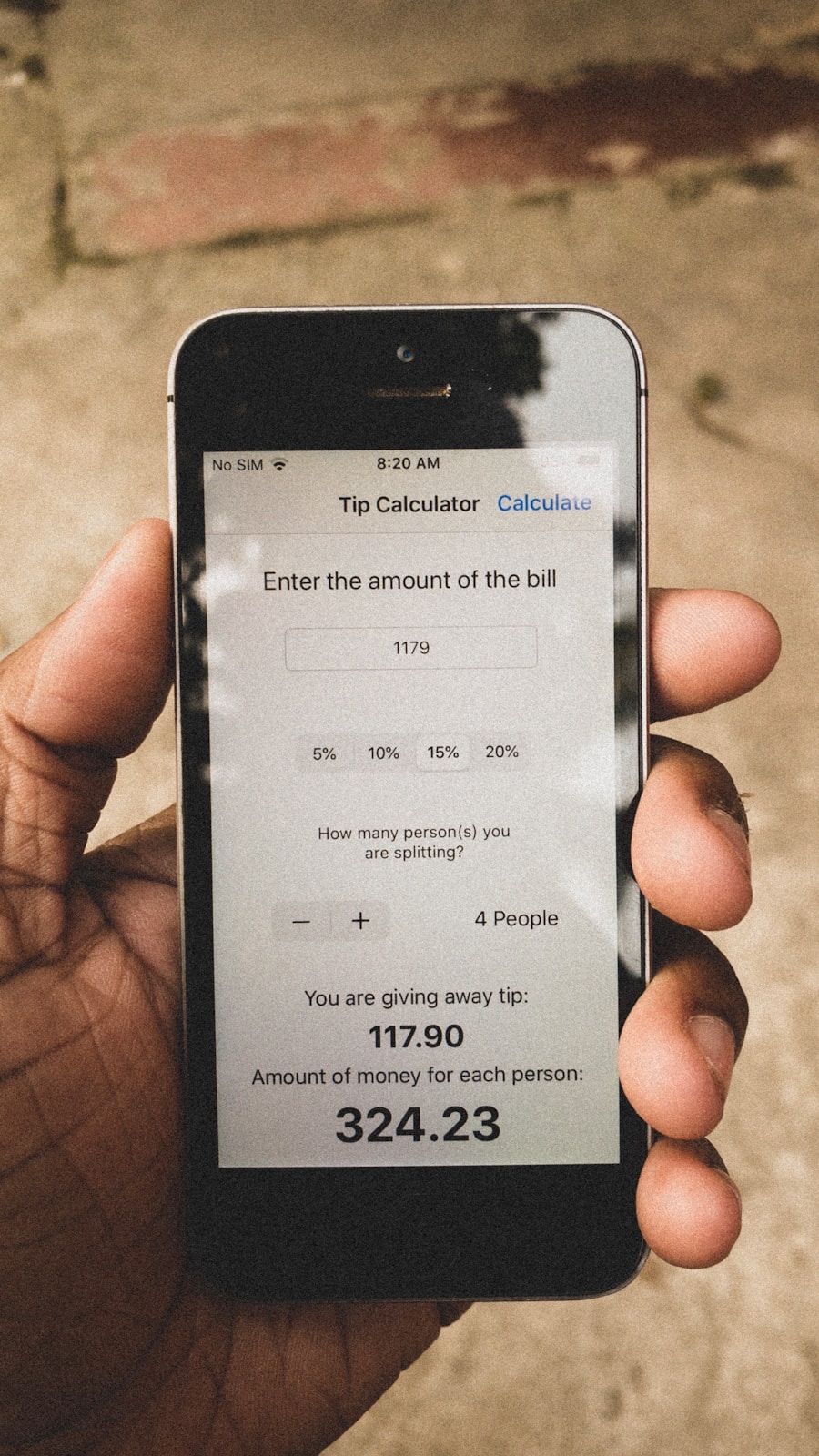

When searching for a free iOS expense tracker app, several key features should be considered to ensure it meets your needs effectively. First and foremost, user-friendliness is crucial. The app should have an intuitive interface that allows users to input expenses quickly and easily without feeling overwhelmed by complex navigation.

A clean design with straightforward categorization options can significantly enhance the user experience, making it more likely that individuals will consistently use the app. Another important feature is the ability to sync with bank accounts and credit cards. This functionality allows for automatic transaction imports, reducing the need for manual entry and minimizing the risk of errors.

Additionally, look for apps that offer customizable categories and tags, enabling users to tailor their tracking system according to their unique spending habits. Reports and analytics are also valuable features; they provide visual representations of spending trends over time, helping users understand their financial behavior at a glance.

Top Free iOS Expense Tracker App Options

| App Name | Downloads | User Rating |

|---|---|---|

| Expensify | 5,000,000+ | 4.7 |

| Wallet – Finance Tracker and Budget Planner | 2,000,000+ | 4.6 |

| Goodbudget Budget Planner | 1,000,000+ | 4.5 |

| Wally | 500,000+ | 4.4 |

| Money Lover | 10,000,000+ | 4.8 |

Several free iOS expense tracker apps stand out in the crowded marketplace, each offering unique features tailored to different user preferences. One popular option is Mint, which not only tracks expenses but also provides budgeting tools and credit score monitoring. Mint’s ability to sync with various bank accounts makes it easy for users to see all their financial information in one place.

The app categorizes transactions automatically and offers insights into spending habits, making it a comprehensive tool for personal finance management. Another noteworthy app is PocketGuard, which focuses on helping users understand how much disposable income they have after accounting for bills, goals, and necessities. Its simple interface allows users to see at a glance how much money is available for discretionary spending.

PocketGuard also offers features like bill reminders and savings goals, making it an excellent choice for those looking to manage their finances proactively. For those who prefer a more minimalist approach, Spendee offers a visually appealing interface with customizable categories and the ability to create shared wallets for group expenses. This feature is particularly useful for friends or family members who want to track shared costs during trips or events.

Each of these apps provides unique functionalities that cater to different financial management styles, allowing users to choose one that aligns with their specific needs.

How to Choose the Best Expense Tracker App for Your Needs

Selecting the best expense tracker app requires careful consideration of individual financial goals and preferences. Start by assessing your primary objectives: Are you looking to simply track expenses, or do you need comprehensive budgeting tools? Understanding your needs will help narrow down your options significantly.

For instance, if you are primarily interested in tracking daily expenses without the need for extensive budgeting features, a simpler app may suffice. Next, consider the level of integration you desire with your bank accounts and credit cards. Some users prefer manual entry for greater control over their data, while others appreciate automatic syncing for convenience.

Additionally, think about whether you want an app that offers detailed reports and analytics or one that focuses on straightforward expense tracking. Reading user reviews and exploring app demos can provide valuable insights into how well an app performs in real-world scenarios.

Tips for Using an Expense Tracker App Effectively

To maximize the benefits of an expense tracker app, users should adopt certain best practices that enhance its effectiveness. Consistency is key; regularly inputting expenses ensures that the data remains accurate and up-to-date. Setting aside a specific time each week or month to review transactions can help reinforce this habit.

During these reviews, users should categorize expenses accurately and make adjustments as necessary to reflect any changes in spending behavior. Another effective strategy is to set realistic budgets based on historical spending patterns rather than arbitrary figures. By analyzing past expenses through the app’s reporting features, users can establish budgets that are both achievable and aligned with their financial goals.

Additionally, taking advantage of alerts and notifications can serve as helpful reminders to stay within budget limits or pay upcoming bills on time.

Common Mistakes to Avoid When Using an Expense Tracker App

While expense tracker apps are powerful tools for managing finances, users often fall into common pitfalls that can undermine their effectiveness. One prevalent mistake is neglecting to update the app regularly. Infrequent updates can lead to inaccurate data, making it difficult to assess true spending habits or budget effectively.

Users should strive to input transactions promptly or utilize apps with automatic syncing capabilities to maintain accurate records. Another common error is failing to categorize expenses correctly. Misclassification can distort spending reports and lead to misguided conclusions about financial behavior.

Users should take the time to review categories periodically and adjust them as necessary to ensure they reflect actual spending patterns accurately. Additionally, some individuals may overlook the importance of setting financial goals within the app; without clear objectives, it becomes challenging to measure progress or stay motivated.

The Importance of Tracking Expenses and Using the Right App

Tracking expenses is an essential practice that empowers individuals to take control of their financial lives. By utilizing an expense tracker app tailored to their needs, users can gain valuable insights into their spending habits, identify areas for improvement, and ultimately work towards achieving their financial goals. The right app can simplify this process significantly, offering features that enhance usability and provide meaningful data analysis.

As technology continues to evolve, the landscape of personal finance management will undoubtedly change as well. However, the fundamental principle remains: understanding one’s financial situation is crucial for making informed decisions about money management. By embracing expense tracking through effective apps, individuals can cultivate healthier financial habits that lead to long-term stability and success.

If you are looking for the best expense tracker app for iOS that is free, you may want to check out Valapoint’s list of top personal finance apps to track your net worth today. This article provides a comprehensive overview of various apps that can help you manage your finances effectively. You can find the article here.